Claiming Personal Superannuation Contributions & What Is Involved

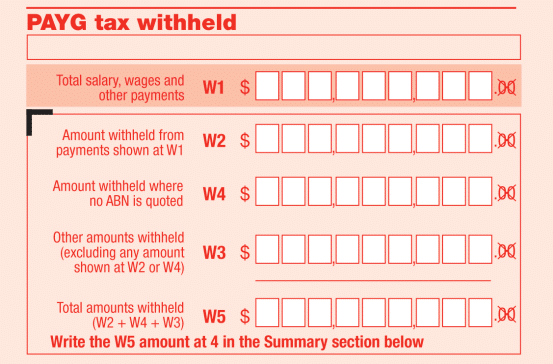

Claiming deductions for personal super contributions Have you made personal super contributions in the last financial year? You may be eligible to claim a tax deduction. In this article, we’ll discuss your eligibility to claim tax deductions, as well as how to make a claim. Let’s jump right into it. What kind of superannuation contributions…