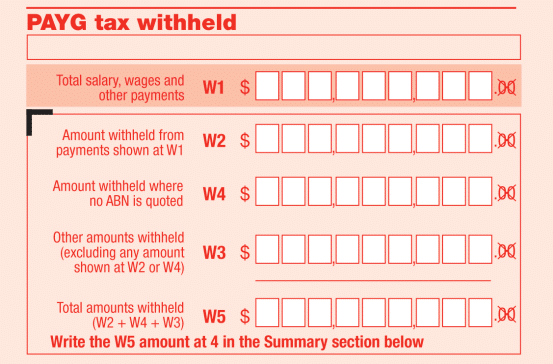

Taxable Payments Annual Report (TPAR) : What you need to know

The Taxable payments annual report (TPAR) gives the ATO valuable information about payments made to contractors for providing services. The ATO uses these reports to identify and follow-up with contractors that haven’t met their tax obligations. Do I need to lodge a TPAR? A whole variety of businesses and entities are required to lodge a…