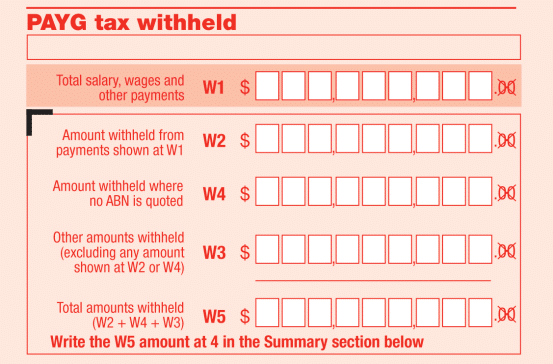

ATO Arrangements If Not Met Can Inhibit a Client’s Ability to Borrow Funds

Not Meeting Your ATO Arrangements Makes it Difficult to Borrow the Funds You Need Have you entered into an arrangement with the Australian Taxation Office (ATO)? Were you unable to pay your tax debt on time and have opted for a pay-by-instalment plan? Have you missed a payment? Unfortunately, ATO arrangements, if not met, can…