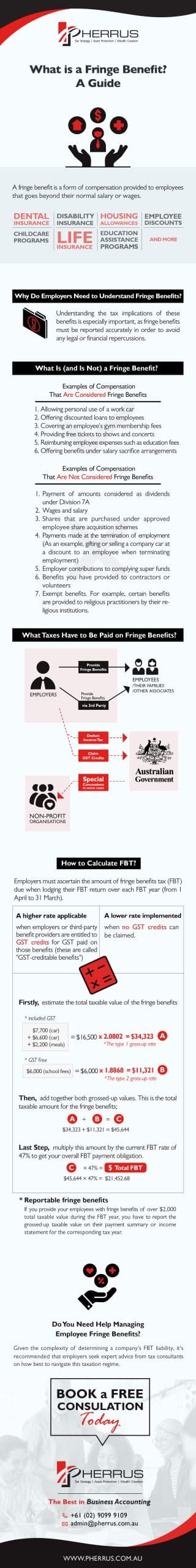

A fringe benefit is a form of compensation provided to employees that goes beyond their normal salary or wages.

These benefits can include things like health and dental insurance, life insurance, disability insurance, housing allowances, education assistance programs, childcare programs, employee discounts, and more.

Fringe benefits are usually provided by employers to attract and retain qualified employees and can be a major factor in job satisfaction.

Fringe benefits are also a way for employers to show their appreciation for employees’ hard work and dedication, which helps build loyalty and morale in the workplace.

In this guide, we’ll take a look at what is a reportable fringe benefit, which benefits are not classed as fringe benefits, and the tax rules surrounding fringe benefits as set out in the Fringe Benefits Tax Assessment Act 1986.

Why Do Employers Need to Understand Fringe Benefits?

Employers need to understand what is a fringe benefit. Although fringe benefits are often used as an incentive to attract and retain talent, employers need to keep in mind that these perks are subject to taxation under the Fringe Benefits Tax (FBT) regulations.

Understanding the tax implications of these benefits is especially important, as fringe benefits must be reported accurately in order to avoid any legal or financial repercussions.

It is essential for employers to know what is and isn’t a fringe benefit, how the different fringe benefits are taxed, what reporting requirements need to be met, and how they can accurately calculate any taxes due.

A thorough understanding of fringe benefit tax rules is essential to any responsible employer who wants to comply with applicable laws and regulations while offering attractive compensation packages that benefit both the employer and the employee.

What Is (and Is Not) a Fringe Benefit?

An employer may offer a fringe benefit as an additional incentive to its employees, in addition to their salary or wages, or in exchange for taking a lesser amount of salary through a salary sacrifice arrangement.

To qualify as a fringe benefit they must be provided ‘in respect of employment’ – this means that they must have some direct connection with the employee’s job or services rendered by them for their employer.

Most benefits that are not cash compensation are considered to be a fringe benefit. However, some benefits such as sick leave, holiday pay, and superannuation contributions are not considered fringe benefits.

Importantly, fringe benefits do not include any form of salary or wages paid to an employee.

These payments are subject to income tax even if they don’t exceed the thresholds set out in the FBT Assessment Act. Nor do they include any form of superannuation contributions made on behalf of an employee, as these contributions are also subject to different rules than those that apply to fringe benefits.

The rules around fringe benefits can be complex. For example, some fringe benefits, like cars, have a separate rate for calculating the taxable value and FBT payable on these benefits.

The answer to the question ‘what is a reportable fringe benefit’ is complicated because some reportable fringe benefits may be difficult to identify.

Whilst there is no specific category of ‘entertainment fringe benefit’, employers may be liable for tax on a number of different types of benefits that arise as a result.

For example, there may be an expenses fringe benefit that occurs from an employee purchasing tickets to an entertainment event and claiming the amount back on expenses.

Examples of Compensation That Are Considered Fringe Benefits

Fringe benefits can take many forms, including:

- Allowing personal use of a work car

- Offering discounted loans to employees

- Covering an employee’s gym membership fees

- Providing free tickets to shows and concerts

- Reimbursing employee expenses such as education fees

- Offering benefits under salary sacrifice arrangements

Examples of Compensation That Are Not Considered Fringe Benefits

Examples of compensation not considered fringe benefits:

- Payment of amounts considered as dividends under Division 7A

- Wages and salary

- Shares that are purchased under approved employee share acquisition schemes

- Payments made at the termination of employment (As an example, gifting or selling a company car at a discount to an employee when terminating employment)

- Employer contributions to complying super funds

- Benefits you have provided to contractors or volunteers

- Exempt benefits. For example, certain benefits are provided to religious practitioners by their religious institutions.

What Taxes Have to Be Paid on Fringe Benefits?

So, what is a fringe benefit tax Australia based? In Australia, the employer is responsible for paying the correct amount of tax on any fringe benefits.

Employers are liable to pay FBT on certain benefits they provide to their employees, their families, or other associates. Even if the benefit is provided by a third party under an employer’s arrangement, FBT still applies.

The taxable value of a fringe benefit determines the amount of FBT that must be paid and self-assessed for each financial year (April 1 to March 31). Such self-assessment leads to the lodging of an FBT return.

Employers may generally deduct income tax for the cost of providing fringe benefits and for any FBT payments made. Furthermore, GST credits can be claimed for goods or services offered as fringe benefits.

Non-profit organisations may also qualify for special concessions in some cases.

How to calculate FBT

Employers must ascertain the amount of fringe benefits tax (FBT) due when lodging their FBT return over each FBT year (from 1 April to 31 March).

When calculating the FBT liability, employers must take into account the taxable value of benefits provided to employees, and on that basis estimate the gross salary they would need to earn at the highest marginal rate of tax (this includes any Medicare levy) in order to acquire those benefits after their taxes are paid.

Two different gross-up rates are used for determining fringe benefits taxable amounts: a higher rate applicable when employers or third-party benefit providers are entitled to GST credits for GST paid on those benefits (these are called “GST-creditable benefits”), and a lower rate implemented when no GST credits can be claimed.

The amount payable is equal to the fringe benefits taxable sum multiplied by the FBT rate in force.

To identify how much FBT needs to be paid:

- Use the applicable regulations to estimate the taxable value of every fringe benefit provided to each employee

- Calculate the overall taxable value of all the fringe benefits which entitle you to claim a GST credit. Include any excluded fringe benefits in this step

- Multiply that total by 2.0802 (the type 1 gross-up rate) in order to get the grossed-up taxable value

- Determine the total taxable amount for those benefits which do not qualify for a GST credit

- Multiply that total by 1.8868 (the type 2 gross-up rate)

- Add together both grossed-up values. This is the total taxable amount for the fringe benefits

- Multiply this amount by the current FBT rate of 47% to get your overall FBT payment obligation.

Reportable fringe benefits

If, as an employer, you provide your employees with fringe benefits of over $2,000 total taxable value during the FBT year, you have to report the grossed-up taxable value on their payment summary or income statement for the corresponding tax year.

Gross-up the reportable fringe benefits using the lower gross-up rate.

For example, if your employee received certain fringe benefits with a $4,000.01 total taxable value for the FBT year ending in March 2022, the reportable fringe benefits amount is $7,546.

Do You Need Help Managing Employee Fringe Benefits?

Let’s recap on what we covered in the ‘What Is A Fringe Benefit’ guide.

In Australia, fringe benefits tax (FBT) is a levy imposed by the Australian government on employers who offer certain non-cash benefits to their employees, directors, associates and trustees.

We learned about what is a reportable fringe benefit. These fringe benefits may include items such as vehicles, computers, accommodation, or travel and can be offered either in place of wages or salary or alongside them.

FBT is calculated separately from income tax and is based on the taxable value of the benefit. Employers must keep records of their FBT liability and documents required to assess this for at least five years.

Employers must complete a self-assessment of their FBT liability each FBT year (April 1 – March 31) and then lodge a Fringe Benefits Tax return.

They may also claim a deduction of income tax for the cost of providing fringe benefits, as well as GST credits if applicable. Non-profit organisations may also qualify for specific concessions when it comes to FBT levies.

It is essential for employers in Australia to be aware of their obligations when providing employee fringe benefits so that they remain compliant with the law and avoid any potential penalties or fines from the ATO for non-compliance.

Given the complexity of determining a company’s FBT liability, it’s recommended that employers seek expert advice from tax consultants on how best to navigate this taxation regime.

Book a FREE consultation with our tax and financial services accountants today to ensure you are paying the correct amount of FBT and maximising your tax deductions.