If you’re off work with an injury and receiving workers’ compensation, you might worry about whether your superannuation is still growing while you’re focusing on getting better.

It’s a common point of confusion.

Employees often don’t know what they’re entitled to, and many employers are unsure of their obligations.

This guide is for both employees and employers.

It will clarify if and when super is paid on workers’ compensation to help employees know what to expect and make informed decisions and to help employers meet their obligations with confidence.

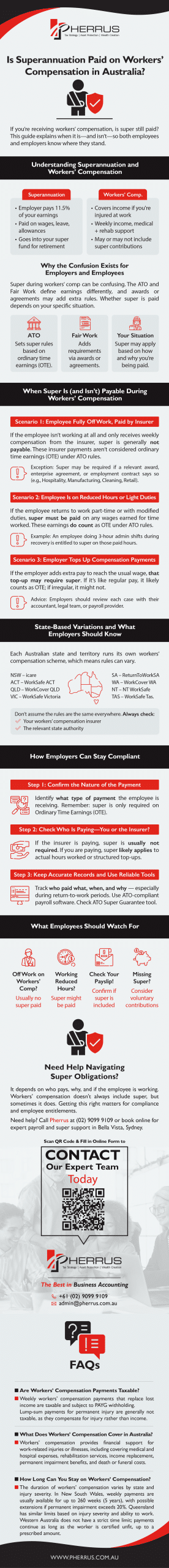

Understanding Superannuation and Workers’ Compensation

Defining Both Terms

Each time an employer pays an employee, they add a percentage of the employee’s ordinary time earnings (base pay, paid leave, and allowances) to a superannuation fund.

As of 2025, the minimum percentage—called the Superannuation Guarantee (SG)—an employer must contribute is 11.5%.

Super is paid to most employees, whether full-time, part-time, or casual.

The employer pays this super on top of regular wages; it’s not taken from the employee’s pay.

The money goes into the employee’s nominated super fund and gets invested until the employee retires.

Workers’ compensation is insurance that covers employees if they get injured or sick due to their job.

It’s typically paid out as weekly payments to cover lost income, with separate payments for medical and rehabilitation expenses.

Now that we understand these terms, we come to the question: is superannuation paid on workers’ compensation?

Why the Confusion Exists for Employers and Employees

There’s a lot of confusion around whether superannuation is paid on workers’ compensation because different government bodies use different definitions and rules.

Which government bodies?

The ATO is responsible for superannuation, including the SG or superannuation rate and the rules for when employers must pay super.

The Fair Work Commission comes into the picture when an award or enterprise agreement requires super payment in addition to the legal requirements under the SG.

The ATO and Fair Work Commission don’t always align regarding what counts as “ordinary time earnings” (OTE), which affects whether super must be paid.

On top of that, there’s no single rule that applies to every situation.

Whether super is paid depends on the type of payment, the worker’s employment status, and any applicable awards or agreements.

That’s why it’s important to look at the specific details of each case.

When Super Is (and Isn’t) Payable During Workers’ Compensation

Scenario 1: Employee Is Completely off Work and Paid by Insurer

If an employee is not working at all and receiving weekly payments from the workers’ compensation insurer, superannuation is generally not payable.

Under ATO rules, these compensation payments don’t count as ordinary time earnings (OTE), and super is only required on OTE.

There is no obligation for an employer to pay super unless a relevant award, enterprise agreement, or contract says otherwise.

For example

- Building and Construction Industry Award 2020

- Manufacturing Award

- Hospitality Award

- Cleaning Services Award 2020

- Retail Industry Enterprise Agreement in NSW

Scenario 2: Employee Is on a Return-To-Work Plan or Reduced Hours

If an employee is on a return-to-work plan and performing light duties or reduced hours, superannuation is usually payable.

Any payments made for actual hours worked are considered OTE under ATO rules.

So, if an employee is back at work in any capacity and getting paid for that time, their employer must pay super on those earnings as usual.

Scenario 3: Employer Is Topping Up Workers’ Compensation Payments

Sometimes, an employer may top up workers’ compensation payments so the employee receives their full pre-injury wage.

In this case, the top-up portion may classify as OTE and attract superannuation contributions.

Whether super is payable on the top-up depends on how the payment is structured and the reason for it.

For example, if the top-up is paid as a form of regular earnings or is linked to hours the employee would usually work, it’s more likely to count as OTE.

But if it’s a discretionary or one-off payment, it may not.

Employers need to assess top-up payments on a case-by-case basis, ideally in consultation with their payroll team, legal advisors, or accountant to make sure they meet any super obligations.

State-Based Variations and What Employers Should Know

Every state and territory in Australia has its own workers’ compensation scheme.

- NSW: icare

- ACT: WorkSafe ACT

- QLD: WorkCover Queensland

- VIC: WorkSafe Victoria

- SA: ReturnToWorkSA

- WA: WorkCover WA

- NT: NT WorkSafe

- TAS: WorkSafe Tasmania

The goal of all these schemes is the same: to support injured workers with lost wages, medical costs, and rehab while they recover.

In some states, super might be required under specific awards or enterprise agreements.

In others, the workers’ compensation insurer may not cover super, even if the employee receives weekly payments.

There may also be differences in return-to-work arrangements and whether those earnings attract super.

Because of these variations, employers must contact their workers’ compensation insurer or the relevant state authority for confirmation and compliance.

How Employers Can Stay Compliant

Step 1: Confirm the Nature of the Payment

Identify what type of payment the employee is receiving.

Is it a regular wage, a compensation payment from the insurer, a top-up from you, or a payment for hours worked?

Remember—super is only payable on OTE, and not all payments count as OTE under ATO rules.

Step 2: Check Who Is Paying—You or the Workers’ Compensation Insurer?

If the payment comes from a workers’ compensation insurer, it usually doesn’t count as OTE, so super isn’t required.

But if you pay wages, a top-up, or any amount for hours worked, then part or all of that payment may attract super.

Step 3: Keep Accurate Records and Use Reliable Tools

Accurate records make it easier to confirm if super was required and prove compliance if needed.

So, keep records of all employee payments made during workers’ compensation, including who paid them, how much, and why.

Use up-to-date payroll software compliant with superannuation and workers’ compensation rules to track and calculate super correctly.

You can also refer to the ATO’s superannuation guarantee eligibility decision tool to help determine if your employees are eligible for super while receiving workers’ compensation.

What Employees Should Watch For

Know if You’re Being Paid Super While on Workers’ Compensation

If you’re off work due to a work-related injury or illness and receiving workers’ compensation, your employer likely isn’t paying superannuation.

However, if you work reduced hours, receive top-up payments from your employer, or are covered by an award or agreement that requires it, you may be entitled to super payments.

Check your payslip to see if you receive super contributions, or ask your employer or HR representative for clarification.

Understand the Long-Term Impact of Missing Super

Time away from work without super contributions can slow down your retirement savings.

If feasible, consider contributing voluntarily to keep your super growing while you’re off.

Even small amounts can help reduce the long-term impact and keep your retirement savings on track.

Need Help Navigating Super Obligations?

Is superannuation paid on workers’ compensation?

It depends on who’s paying, why, and whether the employee is still working.

Workers’ compensation doesn’t automatically mean super, but contributions can still apply in some cases.

Understanding when super is payable during workers’ compensation can be tricky, and getting it wrong can lead to compliance issues for employers and missed entitlements for employees.

Contact Pherrus today for expert payroll and superannuation support.

Call (02) 9099 9109 to book an appointment with an experienced accountant at our Bella Vista office in Sydney.

Alternatively, complete this online form, and we’ll be in touch soon.

FAQs About Superannuation and Workers’ Compensation

Are Workers’ Compensation Payments Taxable in Australia?

In Australia, the tax treatment of workers’ compensation payments depends on the payment type.

Weekly compensation payments, which replace a worker’s regular income while they cannot work, are considered taxable and subject to Pay As You Go (PAYG) withholding tax.

Compensation received as a lump sum for permanent impairment or injury is generally not taxable, as it’s considered compensation for the injury rather than income.

What Does Workers’ Compensation Cover in Australia?

Workers’ compensation provides financial support to employees who suffer work-related injuries or illnesses.

Coverage typically includes

- Medical and hospital expenses

- Rehabilitation services

- Income replacement

- Permanent impairment benefits

- Death or funeral benefits

How Long Can You Stay on Workers’ Compensation in Australia?

How long you can receive workers’ compensation depends on the rules in your state or territory and the severity of your injury.

For example

- New South Wales: Weekly payments are generally available for up to 260 weeks (5 years). You may be eligible for extended benefits if your permanent impairment is assessed at more than 20%.

- Queensland: Similar provisions apply, with payments typically capped at 5 years, depending on the injury’s severity and your capacity to work.

- Western Australia: There isn’t a strict time limit; payments continue as long as you’re certified unfit for work, up to a prescribed amount.