As a small business owner, the prospect of a workers comp audit can be daunting.

With the complex regulations and paperwork required, it’s easy to feel overwhelmed and anxious.

With Pherrus Financial Services on your side, you can breathe easy.

We will help make the audit process simple and stress-free for you.

Contact us today to find out how our experienced accountants can take care of your worker’s comp audit.

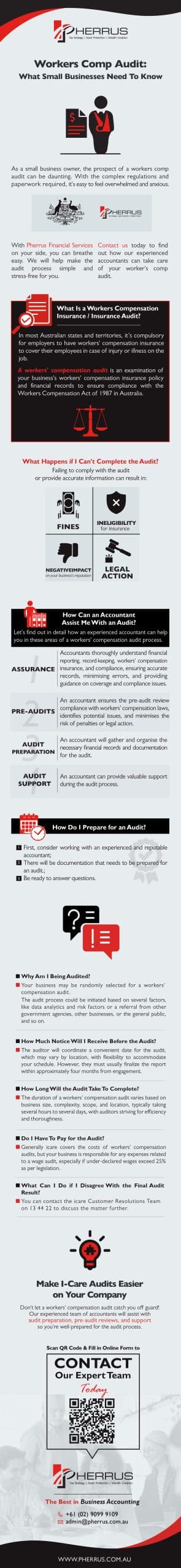

What Is a Workers Compensation Insurance / Insurance Audit?

In most Australian states and territories, it’s compulsory for employers to have workers’ compensation insurance to cover their employees in case of injury or illness on the job.

As a business owner, part of this insurance requirement means you may be liable to undergo an audit.

A workers’ compensation audit is an examination of your business’s workers’ compensation insurance policy and financial records to ensure compliance with the Workers Compensation Act of 1987 in Australia.

The responsibility for conducting workers’ compensation insurance audits falls to the relevant state or territory government agency that administers the insurance in that jurisdiction.

The audit process and requirements may be similar across different jurisdictions, as they’re based on national standards and regulations established by the Australian government.

In New South Wales, icare (Insurance and Care New South Wales) conducts workers’ compensation insurance audits.

This government corporation is also responsible for

- Administrating workers’ compensation insurance and other insurance schemes.

- Overseeing compliance with workers’ compensation laws and regulations.

- Promoting workplace safety and injury prevention.

An audit takes place by mail, phone, or in person.

An auditor will review your business’s payroll records, tax returns, insurance certificates, and other relevant financial documents.

They’ll also check that you’ve paid the correct premiums based on your employees’ work classifications and wage levels.

As a small business owner, you are responsible for providing accurate payroll and financial records and cooperating with the auditor during the audit process.

You’ll also need to answer any questions they may have about your business’s operations.

Complying with the law regarding a workers’ compensation audit is essential to protect your business and employees.

What Happens if I Can’t Complete the Audit?

Failing to comply with the audit or provide accurate information can result in penalties, fines, and possible legal action.

Penalties and consequences associated with non-compliance include

- Fines. Failure to comply with an audit or providing false information can result in significant fines. For example, if you do not keep sufficient records of payments made to deemed workers or contractors, you may face a penalty of up to $55,000 (or 500 penalty units). Providing false or misleading information to an insurer to obtain or renew a workers’ compensation policy can result in a penalty of up to $11,000 (or 100 penalty units). If any declarations are incorrect, insurers may charge a late payment fee of 1.2% per month on the outstanding balance of each month.

- Legal action. If you fail to comply with a workers’ compensation audit or provide false information, legal action may be taken, resulting in further fines and other legal penalties.

- Ineligibility for insurance. You must comply with the requirements of the Workers Compensation Act to be eligible for workers’ compensation insurance. Otherwise, you’ll be personally liable for any compensation claims made by your employees in the event of injury or illness on the job.

- Negative impact on your business’s reputation. Failing an audit makes it difficult to attract and retain customers, as well as quality employees.

How Can an Accountant Assist Me With an Audit?

Preparing for a workers’ compensation audit can be complex, time-consuming, and stressful for you as a business owner.

But it doesn’t need to be!

An experienced accountant will help streamline and simplify the audit process by assisting in the following ways:

- Helping with record-keeping and reporting financial records.

- Calculating and preparing payroll records.

- Ensuring compliance with workers’ compensation audit requirements.

- Advising on insurance policies and coverage.

- Liaising with auditors on your behalf.

Let’s find out in detail how an experienced accountant can help you in these areas of a workers’ compensation audit process.

Assurance

Accountants thoroughly understand financial reporting, record-keeping requirements, and the rules and regulations related to workers’ compensation insurance.

As such, they can provide assurance by ensuring your financial records are accurate, minimising the likelihood of errors or discrepancies during an audit.

They’ll also provide guidance on compliance with workers’ compensation insurance requirements, advising you on the right level of coverage for your employees and accurate premium calculations.

Accountants can further advise you on policies and procedures to prevent future compliance issues.

Pre-Audits

A pre-audit review is crucial in preparing your business for a successful audit.

During this review, an accountant will examine your business’s compliance with workers’ compensation law, including the appropriateness of your workers’ compensation insurance coverage and whether you have met reporting and record-keeping requirements.

By conducting a pre-audit review, an accountant can identify potential compliance issues early on and take corrective action to address them, minimising the risk of penalties or legal action.

Audit Preparation

An accountant will gather and organise the necessary financial records and documentation for the audit.

They’ll prepare your audit records to present to your workers’ compensation insurance provider and the audit conductor.

Audit Support

An accountant can provide valuable support during the audit process.

They will liaise with auditors on your behalf and answer any questions you may have. They can also assist with any required post-audit follow-ups.

Working with an accountant will help the workers’ compensation audit process run smoothly for you.

They’ll provide the expertise, guidance, and support needed to protect your business and employees.

How Do I Prepare for an Audit?

You can follow some basic steps to prepare for an audit.

First, consider working with an experienced and reputable accountant to ensure your financial records are accurate and complete and to provide assurance for the audit.

There will be documentation that needs to be prepared for an audit. This can include

- Payroll information/PAYG payment summary report.

- Profit and loss statements.

- Employees’ employment contract details.

- Workers’ compensation insurance policy details.

- Employees’ long service leave and superannuation payment details.

- Subcontractor listing with their ABNs and total amounts paid.

- A trading statement (if applicable).

- A Fringe Benefits Tax return (if applicable).

- A working sheet displaying how you determined the declared wages.

Finally, be ready to answer questions. The auditor may ask about your business’s operations, financial records, and workers’ compensation insurance policies.

FAQs About Workers’ Comp Audit Services

Here are answers to some frequently asked questions about workers’ comp audit services.

Keep in mind that professional accounting services can play a critical role in preventing problems and overcoming obstacles for your business that may arise during an audit.

Why Am I Being Audited?

Your business may be randomly selected for a workers’ compensation audit.

The audit will verify you have the appropriate level of coverage for your employees and that your insurance premiums have been accurately calculated based on your employees’ job classifications and wages.

The audit process could be initiated based on several factors, including data analytics and risk factors or a referral from other government agencies, other businesses, or the general public.

Non-submission of required declarations or reports can also lead to an audit.

How Much Notice Will I Receive Before the Audit?

An auditor will contact you to arrange a suitable date for the audit.

The timeframe for the audit may vary depending on the state or territory your business is in, but auditors generally have some flexibility in scheduling to accommodate your needs.

However, the auditor must typically complete their final report within a certain timeframe, usually around four months from engagement.

How Long Will the Audit Take To Complete?

The duration of a workers’ compensation audit depends on the size and complexity of your business, the scope of the audit, and the state or territory of your business location.

Generally, an audit can take several hours to several days to complete, depending on the extent of the review required.

Auditors will work with you to complete the audit as efficiently as possible while ensuring they review all necessary information and documentation.

Do I Have To Pay for the Audit?

You generally will not have to pay for an icare workers’ compensation audit, as icare typically covers these costs. However, icare is not responsible for any costs incurred by your business regarding a wage audit.

It’s important to note that if the audit reveals that your business has under-declared wages by 25% or more, legislation dictates you may be responsible for the audit costs.

What Can I Do if I Disagree With the Final Audit Result?

If you disagree with the final results of your icare workers’ compensation audit, you can contact the icare Customer Resolutions Team on 13 44 22 to discuss the matter further.

Make I-Care Audits Easier on Your Company

Don’t let a workers’ compensation audit catch you off guard!

Our experienced team of accountants will assist with audit preparation, pre-audit reviews, and support so you’re well-prepared for the audit process.

We’ll provide the assurance and guidance you need to ensure a successful and less stressful audit that protects your business and employees.

Contact Pherrus Financial Services today, and let us help you confidently navigate the audit process.

Fill in our online form, and we’ll be in touch shortly.

Alternatively, call us to book an appointment at our Bella Vista office in Sydney, NSW.