“Does it stay or does it go?”

If you’ve ever asked this question about something while inspecting a property to buy, sell, or lease, this blog is for you!

The difference between fittings and fixtures can affect your rights, responsibilities, and even your final sale price or rental agreement.

What are fittings and fixtures? Let’s find out!

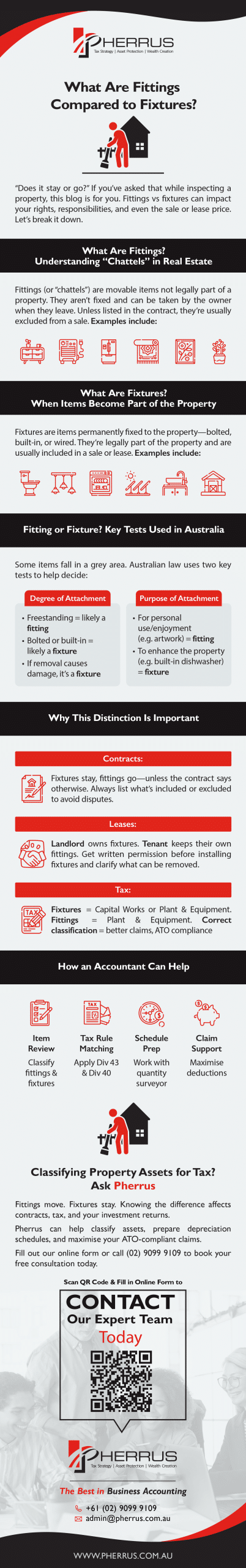

What Are Fittings? Understanding “Chattels” in Real Estate

Fittings are items that are not legally considered part of the property.

They’re also known as “chattels”—objects that owners can take with them when they leave.

These items are not permanently attached to the property or land and can be removed without causing damage.

Because of this, fittings are usually excluded from a property sale unless specified otherwise in the contract.

Common fitting examples include

- Freestanding fridges and washing machines

- Furniture

- Items hung on walls (pictures, paintings, mirrors)

- Portable heaters and air conditioners

- Curtains and blinds hung on removable rods or clip-on brackets

- Rugs and mats

- Outdoor potted plants

What Are Fixtures? When Items Become Part of the Property

Fixtures are items permanently attached to the property or land.

Because they’re bolted, built-in, or wired, they’re legally considered part of the property and usually included in the sale or lease.

Common fixture examples include

- Built-in wardrobes and cupboards

- Ceiling lights and wall sconces

- Split system and ducted air conditioning units

- Dishwashers integrated into cabinetry

- Toilets, sinks, taps, and showerheads

- Kitchen benchtops and cabinetry

- Security systems and intercoms

- Solar panels and hot water systems

- Sheds built on concrete slabs or connected to utilities

Fitting or Fixture? Key Tests Used in Australia

Unfortunately, it’s not always obvious whether something is a fitting or a fixture.

Some items sit in a grey area.

That’s why ownership disputes sometimes end up in court.

To help make the distinction, Australian common law uses two main tests.

These aren’t hard and fast rules, but they are useful guidelines.

- Degree of Attachment (Annexation): How is the item attached?

- If it’s freestanding, like a statue resting on its own weight, it’s likely a fitting.

- If it’s fixed in place, like a machine that’s bolted down, it’s likely a fixture.

- If removing it would cause significant damage to the property or the item itself, it usually counts as a fixture.

- Purpose of Attachment (Annexation): Why was the item attached?

- If it was added for the enjoyment of the item itself, like a painting, it tends to be classified as a fitting.

- If it was installed for the enjoyment/better use of the property as a whole, like a built-in dishwasher, it tends to be classified as a fixture.

Why This Distinction Is Important

For Contracts

The general rule in property sales is that fixtures stay with the property, while fittings go with the seller, unless the contract says otherwise.

Standard sale contracts, like the NSW Contract for Sale of Land, include specific sections for listing fixture and fitting inclusions and exclusions to help avoid disputes.

If an item isn’t listed in the contract but you would like it included, discuss the matter early on in the negotiation process.

For Leases

Fixtures usually stay with the property and belong to the landlord.

Fittings supplied by the landlord before the tenant moved in also remain the landlord’s property.

Fittings installed by tenants belong to them.

As a tenant, you should get written permission before installing household fixtures and clarify whether you can remove them at the end of the lease.

Anything unclear can lead to disputes when vacating the premises.

For Tax

In investment properties, fittings and fixtures are treated differently for tax depreciation purposes.

Getting the classification right helps you claim correctly and avoid issues with the ATO.

Fixtures are depreciated as

- Capital works (Division 43) if they’re part of the building or its permanent features

OR

- Plant and equipment (Division 40) if they’re mechanical or removable

Fittings owned by an investor, such as furniture, portable appliances, and décor items in a furnished rental, are usually classified and depreciated as plant and equipment under Division 40.

How an Accountant Can Help

A qualified accountant can help you correctly identify and classify fittings and fixtures in your investment property for tax purposes.

They’ll determine which items fall under Division 43 (capital works) and which qualify as Division 40 (plant and equipment), maximising your deductions and keeping your claims compliant with ATO rules.

They can also work with a quantity surveyor to prepare a depreciation schedule, making tax time easier and ensuring you don’t miss out on any eligible claims across the life of the property.

Classifying Property Assets for Tax? Ask Pherrus

What are fittings and fixtures?

Fittings move with a house, and fixtures must stay behind!

Understanding that difference matters for sale and lease contracts.

And for property investors at tax time!

Classifying each asset correctly as a fixture or fitting, preparing a depreciation schedule, and working out capital gains tax can affect your investment property deductions and overall returns.

Let the Pherrus Financial Services team help!

We specialise in ATO-compliant property tax strategies tailored to your investment goals.

We’ll take the guesswork out of asset classification and maximise what you’re entitled to claim.

Fill out our online form or call (02) 9099 9109 to book your free consultation today.