Sick of watching your rental income get chewed up by tax?

Of course you are, because you didn’t invest in property just to hand over a chunk of your returns to the ATO!

Knowing how to cut your tax bill—legally, of course!—can make a big difference.

We’ve compiled this guide for Australian individuals, trusts, and companies buying their first investment property or managing a growing portfolio.

We’ll cover how to save tax on an investment property through practical, ATO-compliant strategies.

Please keep in mind that this is general information only, not legal or financial advice.

For guidance tailored to your situation, chat with a tax consultant or accountant at Pherrus.

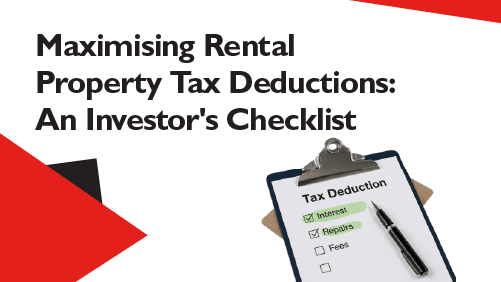

Understanding Investment Property Tax in Australia

If you earn rental income from an investment property, you must declare it in your annual tax return.

You can typically claim deductions for expenses related to owning and managing the property.

To work out your net rental income (or loss), you subtract these allowable expenses from your total rental income.

If the result is a profit, it gets added to your taxable income and taxed at your marginal rate.

If it’s a loss, you may be able to offset it against other income, which could reduce your overall tax bill.

What if you decide to sell the property? Capital Gains Tax may apply if the property has increased in value.

The good news? You can reduce the investment property taxes you owe if you know what to claim and how.

Negative vs Positive Gearing Explained (and Tax Implications)

Gearing refers to borrowing money to invest. How your investment property is geared affects your cash flow and tax position.

- Negative Gearing: When your rental income is less than your deductible property expenses. This creates a net rental loss, which can be offset against your other assessable income, like your salary, reducing your overall taxable income. You can use negative gearing to lower your tax bill while holding your property for long-term capital growth.

- Positive Gearing: When your rental income is more than your expenses. This results in a net rental profit, which you must declare as taxable income. While you’ll pay more tax upfront, you may prefer the steady cash flow and income focus.

- Neutral Gearing: When your rental income roughly equals your expenses, so there’s no loss or profit. There’s little tax impact, but this strategy may support long-term capital gains if the property’s value increases, allowing you to profit when it sells.

Maximising Rental Property Tax Deductions: An Investor’s Checklist

Claiming all legitimate deductions is the most significant way to reduce tax on your investment property.

The more eligible expenses you can claim, the lower your net rental income and the less tax you’ll pay.

What can you claim?

1. Loan Interest

If you’ve borrowed money to buy, renovate, or improve your investment property, the interest on that loan is usually tax-deductible.

But it’s important to understand the rules so you don’t claim too much or too little.

Apportionment

If your loan has a mixed purpose, you can’t claim interest on the private portion.

For example, you’ve used some of the funds to buy a private car or pay personal expenses.

Only the part of the loan used for the investment property is deductible.

The ATO refers to this as apportionment.

Similarly, if you’re using an offset account linked to your investment loan, which is holding personal savings or connected to your primary residence, it may reduce the deductible portion of your interest.

Refinancing

What if you decide to refinance a loan originally for your investment property to secure a better interest rate, switch to a different loan structure, or access equity?

You can still claim the interest on the new loan, provided you continue using the borrowed funds for your property.

But if you refinance the loan and use part of the funds for personal reasons, you’ll need to apportion the interest.

2. Repairs vs Capital Improvements

Repairs are works to fix damage or wear, helping restore the property to its original condition.

These costs are generally fully deductible in the year you incur them.

Examples of repairs:

- Fixing a broken window

- Patching a leaking roof

- Replacing some damaged fence panels

- Replacing a worn section of carpet

Improvements, also known as “capital works”, upgrade or add to the property, making it better than it was.

You can’t claim the full cost of capital works upfront; instead, you may be able to claim a deduction over time through depreciation.

Examples of improvements:

- Adding a new room or extending the property

- Renovating an entire kitchen with upgraded fittings

- Installing ducted air conditioning where there was none before

- Fixing problems or defects that existed at the time you bought the property

3. Everyday Running Expenses (Don’t Miss These!)

- Land Tax: If charged by your state or territory on your property, and it’s rented or available for rent.

- Council Rates: For services like garbage collection and public maintenance.

- Water Charges: If you pay for water usage or supply charges instead of the tenant.

- Body Corporate Fees: Regular contributions to the body corporate if your property is part of a strata title (like an apartment).

- Property Management Fees: Paid to a real estate agent or property manager for handling tenant issues, collecting rent, and managing repairs.

- Legal Fees: Related to rental activities, like evicting a tenant or recovering unpaid rent.

- Accounting and Tax Agent Fees: For preparing your tax return or getting advice related to your property.

- Gardening: Lawn mowing and general garden maintenance required during a tenancy.

- Cleaning: At tenant changeovers or to maintain shared spaces in a rental.

- Pest Control: Treatments like termite inspections and rodent control.

- Advertising for Tenants: Promoting the property when looking for new renters, e.g. online ads or signage.

- Landlord and Building Insurance: Covers rental default, property damage, and legal liability, and premiums are deductible.

The Power of Depreciation: Reducing Tax on Property Construction and Assets

Depreciation is a non-cash tax deduction for the decline in value of assets over time.

It allows you to reduce your taxable income without spending money in that financial year.

There are two main types of depreciation for investment properties.

1. Capital Works Deductions: Claiming Building Costs

Under Division 43 of Australian tax law, you can claim capital works deductions for the gradual wear and tear of the property’s structure and fixed improvements over time.

Eligible works include the original construction cost, structural upgrades (like extensions or garages), and major renovations permanently attached to the property.

To claim capital works deductions, construction on your residential property must have commenced after September 15, 1987.

Then, you can claim 2.5% per year of the total cost of eligible capital works spread over 40 years.

As of January 2025, new incentives have been introduced for eligible build-to-rent developments, increasing the capital works deduction rate to 4% and shortening the depreciation period to 25 years.

You must know your property’s original construction cost and construction date to calculate the annual deduction rate and the number of years remaining in the depreciation period.

If you don’t have this information (it can be unavailable for older properties), a quantity surveyor can prepare a depreciation schedule estimating historical construction costs and all depreciable assets, breaking down what you can claim each year.

2. Depreciating Assets: Claiming Fixtures and Fittings

Under Division 40 of Australian tax law, you can claim depreciation for the fixtures and fittings within your property that are mechanical, removable, or not part of the building structure.

In 2017, the ATO introduced changes to restrict depreciation claims on previously used or “second-hand” assets in residential investment properties.

If you entered into a contract to purchase a residential rental property before 7:30 PM AEST on May 9, 2017, you can continue to claim depreciation on existing second-hand depreciating assets within the property.

For properties purchased after this date, you generally cannot claim depreciation on second-hand assets already in the property at the time of purchase.

However, you can claim depreciation on:

- Brand new assets you purchase and install in the property

- Assets in new properties purchased directly from the developer

- Assets in properties that have undergone substantial renovations

- Assets in commercial properties, as different rules apply

You can use the ATO’s effective life of depreciating assets list to calculate how much you can claim each year as an asset loses value.

Alternatively, a quantity surveyor can recommend effective life estimates when preparing your depreciation schedule.

This schedule will be compliant for tax reporting, reducing the risk of an audit.

As a bonus, the surveyor’s fee is tax-deductible!

There are two methods for calculating depreciation on Division 40 assets.

The Prime Cost Method spreads deductions evenly over the asset’s effective life, while the Diminishing Value Method allows higher deductions in the earlier years, tapering off over time.

An accountant can determine which method suits your investment strategy, asset usage, and cash flow needs.

Ownership Structures: How Buying in the Right Name Saves Tax

The name under which you buy an investment property can significantly impact your tax position. An accountant can help you choose the best fit before you buy.

- Sole Name: You report all income, expenses, and capital gains in your personal tax return and pay tax at your individual marginal rate.

- Joint Tenants: Ownership and tax obligations are split 50/50, regardless of how much each person contributed financially.

- Tenants in Common: Ownership can be split in any percentage. Each owner declares their share of rental property tax deductions, income, and capital gains, offering more flexibility in tax planning.

- Company: Profits are taxed at the corporate tax rate (generally lower than personal rates), but no 50% CGT discount applies.

- Trusts (Discretionary/Family or Unit): Can distribute income to beneficiaries in tax-effective ways. A discretionary (family) trust allows the trustee to decide how income is shared, while a unit trust fixes ownership percentages.

- Self-Managed Super Fund (SMSF): Offers tax advantages (up to 15% on income and 0% in retirement phase) but has strict rules on borrowing, contributions, and property use.

Smart Strategies to Minimise Capital Gains Tax (CGT)

When you sell an investment property, CGT applies to the capital gain, which is the difference between your selling price and the property’s cost base.

Want to know how to reduce Capital Gains Tax? These strategies can help!

Maximise Your Cost Base

Your property’s cost base includes

- Purchase price

- Stamp duty paid on acquisition

- Legal fees for purchase and sale

- Agent’s commission on the sale

- Capital improvement costs (e.g., renovations)

- Non-deductible interest on loans used to acquire the property

Each cost adds to the total amount you’ve spent on the property.

The higher your cost base, the smaller your capital gain when it comes time to sell, and the less CGT you’ll have to pay.

Hold the Property for Over 12 Months

If you’re an Australian resident individual or trust and hold the property for more than 12 months before selling, you’re generally eligible for a 50% CGT discount.

Utilise the Main Residence Exemption (MRE)

If the property was your main residence, you may be fully exempt from CGT.

If you move out and rent the property, you can still claim the Main Residence Exemption for up to 6 years, as long as you don’t nominate any other property as your main residence for tax purposes during that time (even though you’re living elsewhere).

If you rent out the property and don’t meet the conditions for the full exemption, you may still qualify for a partial exemption.

In that case, you’ll only pay CGT on the portion of the gain related to the time the property was used to produce income.

Time Your Sale Strategically

Consider selling in a financial year when your taxable income is lower, as this may place you in a lower tax bracket, reducing the CGT payable.

Additionally, if you have capital losses from other investments, you can use them to offset your capital gains, further reducing your CGT liability.

Pherrus: Your Partner for Smart Property Tax Strategies

Learning how to save tax on your investment property can mean the difference between getting by and getting ahead.

If you’re investing in property for the first time or growing your portfolio, you need the Pherrus financial team on your side.

We can

- Advise on structuring property purchases for optimal tax outcomes

- Advise on repairs vs improvements classifications

- Assist with depreciation schedules

- Calculate and minimise CGT

- Maintain immaculate records to keep you compliant with ATO requirements

- Provide tax strategies tailored to your portfolio and goals

Ready to make your investment property work harder for you?

Fill out our online form or call (02) 9099 9109 to book your free consultation today.

FAQs About “How To Save Tax on Investment Property?”

How Does an Investment Property Reduce Taxes?

The tax benefits of a rental property come from being able to claim deductions for expenses like loan interest, maintenance, management fees, and depreciation.

If these costs exceed your rental income, you can use the loss to lower your taxable income, commonly known as negative gearing.

How Can I Reduce My Taxes When Selling My Investment Property?

You can reduce your taxes when selling your investment property by maximising the property’s cost base, holding the property for over 12 months to access the CGT discount, using the main residence exemption if eligible, offsetting gains with capital losses, and timing the sale in a lower-income year.

Can I Move Into My Rental Property To Avoid Capital Gains Tax?

Moving into your rental property can reduce CGT, but it won’t eliminate it if the property was rented first.

A partial exemption may apply based on how long the property was your main residence versus how long it was rented.