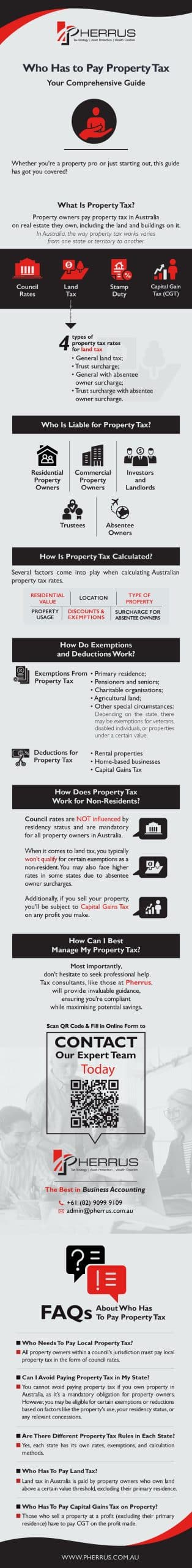

Welcome to the world of Australian property tax, where understanding your obligations is as important as owning the keys to your property!

This no-nonsense guide cuts through the jargon to give you the essentials: who is responsible for property tax, the method for its calculation, an overview of exemptions and deductions, and strategies for managing your tax liabilities.

Whether you’re a property pro or just starting out, this guide has got you covered!

What Is Property Tax?

Property owners pay property tax in Australia on real estate they own.

It’s calculated based on the property’s value, including the land and buildings on it.

Property taxes include

- Council rates: Taxes levied by local councils to fund services like garbage collection, road maintenance, and community facilities.

- Land tax: A state-based tax applied to the value of any land you own, excluding the value of the building or any other structures on it.

- Stamp duty: Also known as transfer duty, you pay this tax based on purchase price or market value when purchasing a property.

- Capital Gains Tax (CGT): This is not a separate tax but part of your income tax. It applies when you sell a property and make a profit. Primary residences are usually exempt, but investment properties are not.

There are four types of property tax rates for land tax, including

- General land tax: The standard land tax rate applied to the total taxable value of all the taxable land you own (excluding your primary residence) above the tax-free threshold. The rate varies depending on the total value of your land holdings.

- Trust surcharge: If the land is held in a trust, an additional surcharge may be applied on top of the general land tax rate. Trusts often have lower tax-free thresholds and higher rates.

- General with absentee owner surcharge: This additional surcharge is applied to foreign or absentee property owners. An absentee owner is typically not an Australian citizen or resident and does not ordinarily reside in Australia. This surcharge is on top of the general land tax rate.

- Trust surcharge with absentee owner surcharge: This surcharge is for properties held in a trust where the beneficiaries are absentee owners. It combines both the trust surcharge and the absentee owner surcharge.

In Australia, the way property tax works varies from one state or territory to another.

Generally, the local council or government authority assesses the value of your property at regular intervals and then applies a tax rate to determine how much you owe.

It’s a recurring expense, meaning you pay it annually as long as you own the property.

The revenue from property tax plays a significant role in the Australian economy, helping to fund essential services like public schools, roads, and emergency services.

So, understanding your property tax obligations is not just about being a responsible property owner; it’s also about contributing to the growth and well-being of the community you’re part of.

Who Is Liable for Property Tax?

Now you understand what property tax is, the next logical question is- Who has to pay property tax?

- Residential property owners: If you own a house, a unit, or any residential property, you’re responsible for property tax. This includes council rates and land tax (unless it’s your primary residence, which is often exempt from land tax).

- Commercial property owners: If you own a shop, office building, or any type of commercial property, you’ll pay property tax on these, too.

- Investors and landlords: If you own investment properties or rent out your property, you’re liable for property tax on these assets- including capital gains tax, if you sell the property for a profit.

- Trustees: If a property is held in a trust, the trustee is responsible for paying property tax and a trust surcharge.

- Absentee owners: If you own property in Australia but live overseas, you might face additional surcharges, especially for land tax.

How Is Property Tax Calculated?

Several factors come into play when calculating Australian property tax rates.

- Property value: The value of your property is the most significant factor in calculating your property tax. This includes the land value and the value of any buildings or structures on it. Local councils or state governments assess property values regularly to determine tax rates.

- Location: Where your property is located influences your property tax. Different states, territories, and municipalities within a state can have varying rates and rules.

- Type of property: Residential properties, commercial properties, and vacant land might be taxed differently. For instance, commercial properties often face higher tax rates than residential properties.

- Property usage: How you use your property also affects your property tax. Investment and rental properties might be subject to different tax considerations compared to a primary residence.

- Discounts and exemptions: Certain properties might qualify for discounts and property tax exemptions in Australia.

- Surcharge for absentee owners: If you’re an absentee owner (an owner who doesn’t reside in Australia), you might have to pay an additional surcharge on your land tax.

The above information broadly applies to the calculation of property taxes in Australia, encompassing both council rates and land tax.

However, the specific application of these factors can differ between the two types of taxes.

Council rates are usually a fixed charge plus a variable charge based on the property’s value, and land tax is calculated based on the total value of all the taxable land you own above a certain threshold, with rates varying by state.

How Do Exemptions and Deductions Work?

Exemptions From Property Tax

- Primary residence: The home you live in most of the time is often exempt from land tax.

- Pensioners and seniors: Some property tax exemptions in Australia are available for pensioners, seniors, or low-income earners.

- Charitable organisations: Properties used for charitable purposes might be exempt from certain property taxes.

- Agricultural land: Some states provide exemptions for agricultural land to support farming activities.

- Other special circumstances: Depending on the state, there may be exemptions for veterans, disabled individuals, or properties under a certain value.

Deductions for Property Tax

- Rental properties: If you own a property you rent out, you can often deduct the property taxes (like council rates and land tax) as an expense against your rental income.

- Home-based businesses: If you use part of your home for business, you may be able to claim a portion of your property taxes as a business expense.

- Capital Gains Tax: While not a direct deduction on property tax, you can reduce your capital gains tax liability by accounting for property taxes paid when calculating your capital gain on the sale of a property.

How Does Property Tax Work for Non-Residents?

Council rates are not influenced by residency status and are mandatory for all property owners in Australia.

When it comes to land tax, you typically won’t qualify for certain exemptions as a non-resident.

You may also face higher rates in some states due to absentee owner surcharges.

Additionally, if you sell your property, you’ll be subject to Capital Gains Tax on any profit you make.

The rules for CGT for non-residents can differ from those for Australian residents, particularly regarding exemptions and how the tax is calculated.

Also, when purchasing property, be prepared for potentially higher stamp duty rates than residents.

FAQs About Who Has To Pay Property Tax

Who Needs To Pay Local Property Tax?

All property owners within a council’s jurisdiction must pay local property tax in the form of council rates.

Can I Avoid Paying Property Tax in My State?

You cannot avoid paying property tax if you own property in Australia, as it’s a mandatory obligation for property owners.

However, you may be eligible for certain exemptions or reductions based on factors like the property’s use, your residency status, or any relevant concessions.

Are There Different Property Tax Rules in Each State?

Yes, each state has its own rates, exemptions, and calculation methods.

Who Has To Pay Land Tax?

Land tax in Australia is paid by property owners who own land above a certain value threshold, excluding their primary residence.

Who Has To Pay Capital Gains Tax on Property?

Those who sell a property at a profit (excluding their primary residence) have to pay CGT on the profit made.

How Can I Best Manage My Property Tax?

With the right approach, effectively managing property tax is possible.

Stay informed about changes in tax laws, understand your specific obligations, and budget for tax payments throughout the year.

Most importantly, don’t hesitate to seek professional help.

Tax consultants, like those at Pherrus, will provide invaluable guidance, ensuring you’re compliant while maximising potential savings.

As tax laws and regulations vary between states and territories, we’ll also help you understand what exemptions and deductions you might be eligible for.

Let’s crack the property tax code together to make sure you’re not paying more than you need to!

Fill out our online form or call +61 (02) 9099 9109 to book an appointment at our Bella Vista office in Sydney, NSW.