Let’s face it: payroll has never been anyone’s favourite part of running a business!

But Single Touch Payroll (STP) is not just another admin task—it’s the law.

If your business (or the business you manage payroll or bookkeeping for) has employees—whether one or one hundred—you must report certain payroll information directly to the ATO every payday.

Getting STP-compliant doesn’t have to be a headache.

And if things are a bit more complicated—say you’ve got multiple entities, contractors, or custom payroll systems—there’s professional help available.

This guide will walk you through how to register for Single Touch Payroll and what help is available so you can stay compliant without the chaos.

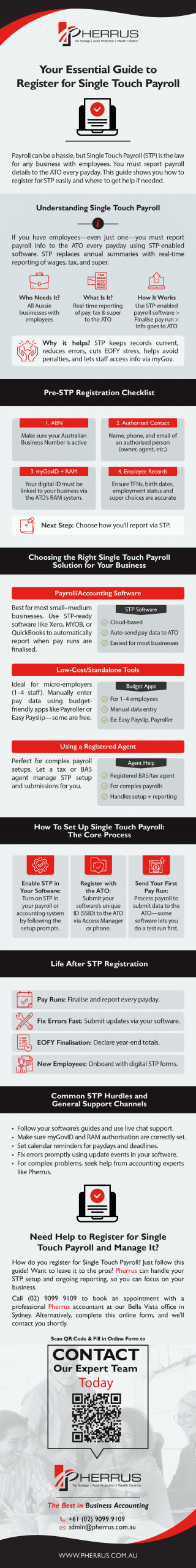

Understanding Single Touch Payroll

If you’re an Australian business (sole trader, company, trust, or partnership) with employees (even just one), you’re required by law to report via Single Touch Payroll.

Larger employers are already on board, and the ATO has gradually brought smaller businesses into the Single Touch Payroll system over the past few years.

STP is how businesses report payroll information to the ATO.

Instead of sending payment summaries once a year, you report wages, superannuation, and PAYG withholding every time you pay your employees.

When you finalise a pay run, the details go to the ATO directly from your STP-enabled payroll software.

The ATO’s goal is to create more transparency and accuracy around payroll, super, and tax obligations.

STP detects non-compliance earlier, supports fairer wage payment systems, and simplifies payroll reporting for businesses. Other STP benefits include

- Keeping your payroll records up to date.

- Reducing the risk of manual errors by automating payroll reporting.

- Maintaining accurate super and tax records to avoid penalties and late payments.

- Saving you time by cutting out duplicate reporting and reducing end-of-financial-year admin.

- Streamlining tax time: employees can access their income, tax, and super info via myGov, and you don’t need to generate payment summaries or group certificates.

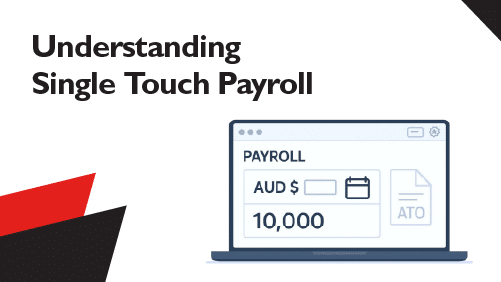

Pre-STP Registration Checklist

Here’s what you’ll need before registering for STP:

- A valid Australian Business Number (ABN)

- The authorised contact’s name, phone number, and email. This can be you as the business owner, a registered tax or BAS agent, a company director, or an employee you’ve officially nominated in your ATO records

- myGovID linked to your business through Relationship Authorisation Manager (RAM), an online ATO tool

- Accurate employee records, including Tax File Numbers, dates of birth, super fund choices, and employment statuses

Now, it’s time to choose your STP reporting method.

Choosing the Right Single Touch Payroll Solution for Your Business

Payroll/Accounting Software

The most common way to report through STP is by using payroll or accounting software that’s STP-enabled.

Most major providers, such as Xero, MYOB, and QuickBooks, include built-in STP reporting features.

Once your Single Touch Payroll software is set up and connected to the ATO, it automatically sends the required payroll information each time you finalise a pay run.

This option suits most small and medium-sized businesses, especially those already using cloud-based accounting or payroll tools.

It helps you stay compliant with minimal extra effort.

Standalone/Low-Cost Solutions

If you’re a micro-employer—a business with one to four employees—you don’t need full-scale payroll software to meet your STP obligations.

Instead, you can choose from a range of standalone or low-cost STP solutions designed for small businesses.

These tools let you manually enter employee pay details and submit them to the ATO.

Many cost under $12 per month, such as Easy Payslip, Payroller, and Reckon STP App, and some offer free options for small businesses.

They’re perfect if your payroll is straightforward and you want to stay compliant without paying for features you don’t need.

Using a Registered Agent

If you’d rather leave STP reporting to an expert, you can authorise a registered tax or BAS agent to report on your behalf.

This option is a particularly good idea if your payroll is more complex, including managing multiple entities, irregular pay runs, or contractors.

Your agent can handle the STP setup, manage the payroll reporting schedule, and make sure everything submitted to the ATO is accurate and on time.

For you, this means fewer admin tasks on your plate and peace of mind that your STP reporting complies with ATO requirements.

How To Set Up Single Touch Payroll: The Core Process

Once you’ve chosen your STP reporting method, you must enable STP reporting and connect your business to the ATO.

The steps can vary slightly depending on your setup, but the core process is generally the same.

- Enable STP in Your Payroll or Accounting Software: Follow your software provider’s instructions to activate the STP feature. Look for terms like “enable STP,” “connect to ATO,” or “STP setup” in the software menu.

- Notify the ATO: Your software should now prompt you to connect it to the ATO in a step called Software ID (SSID) registration. The SSID is a unique code that identifies your software to the ATO. Lodge this ID with the ATO through their Access Manager portal or by calling their STP registration line on 1300 852 232. If you’re using a registered agent, they’ll handle this process.

- Do a Test or First Pay Run: You’re ready to roll! Your first pay run will send your employee payment and tax data directly to the ATO. Some software may offer a test submission first so you can confirm the setup is working.

Life After STP Registration

Now that STP is part of your regular payroll process, here’s what you need to stay on top of:

- Pay Runs. Finalise each pay run on or before payday, checking that all wages, taxes, and super details are correct so your STP software can report the data to the ATO.

- Fixing Mistakes Quickly. If you make an error in a pay run, most software lets you submit an update event to fix the mistake.

- Finalising at EOFY. At the end of the financial year, make a finalisation declaration in your software to confirm that your year-to-date figures are complete and correct.

- Onboarding New Employees. Collect tax and super details digitally through STP-enabled onboarding, a feature in some software that lets new employees submit their details online. It’s quick and paper-free.

Common STP Hurdles and General Support Channels

Like with any new system, there can be some bumps along the way.

You might run into issues with software setup, linking your business in RAM, missed lodgements, and fixing past errors.

To combat these issues

- Follow the step-by-step setup guides and tutorials provided by your STP software provider. Contact their live chat support for help.

- Check that you’ve set up your myGovID and RAM authorisation correctly. The ATO website has instructions, or you can call them.

- Set calendar reminders for pay dates and finalisation deadlines.

- Use your STP software to submit an update event or correction as soon as you notice a mistake.

These resources are great for sorting out smaller issues.

But complex situations call for expert advice from accounting or bookkeeping professionals, like those at Pherrus Financial Services.

Need Help to Register for Single Touch Payroll and Manage It?

How do you register for Single Touch Payroll?

Just follow this guide!

However, if you want to leave STP setup in the hands of professionals so you can focus your time and energy on your business, look no further than Pherrus.

We’ll register your business for STP, efficiently handle your ongoing STP reporting, and give you complete confidence in your STP compliance.

We also offer comprehensive accounting and bookkeeping services to keep your business running smoothly behind the scenes.

Fill out our online form or call (02) 9099 9109 to book your free consultation today.