If you’re an employer, you’ve likely already explored fringe benefits in some capacity. But if you want to know all the details of ‘what is exempt reportable fringe benefits?’ in one location, our handy guide is an excellent place to start.

By understanding what is exempt from reportable fringe benefits Centrelink, it’s a far quicker and easier task to sort out what needs to be reported and what can be avoided.

To learn more about what is considered reportable fringe benefits, – exempt amount, and more – read our complete guide below. We cover all the basics for employers to make fringe benefits streamlined, practical and easy year after year.

Read on now to discover the most common exempt reportable fringe benefits for Australian businesses:

What Makes Some Benefits Exempt from Reporting?

Fringe benefits are a particular type of benefit that many employers offer as a part of a package to employees, providing a competitive incentive in the jobs market.

As an employer, it’s important to report these fringe benefits correctly – and part of that knowledge is knowing what benefits are actually exempt.

Making sure you’re on the right track with reporting the right benefits can help you avoid confusion and problems when you need to send in the right information at the end of the FBT year.

So, what are exempt reportable fringe benefits in the context of acting as an employer, and why are they exempt? There are a few reasons why certain benefits may be exempt.

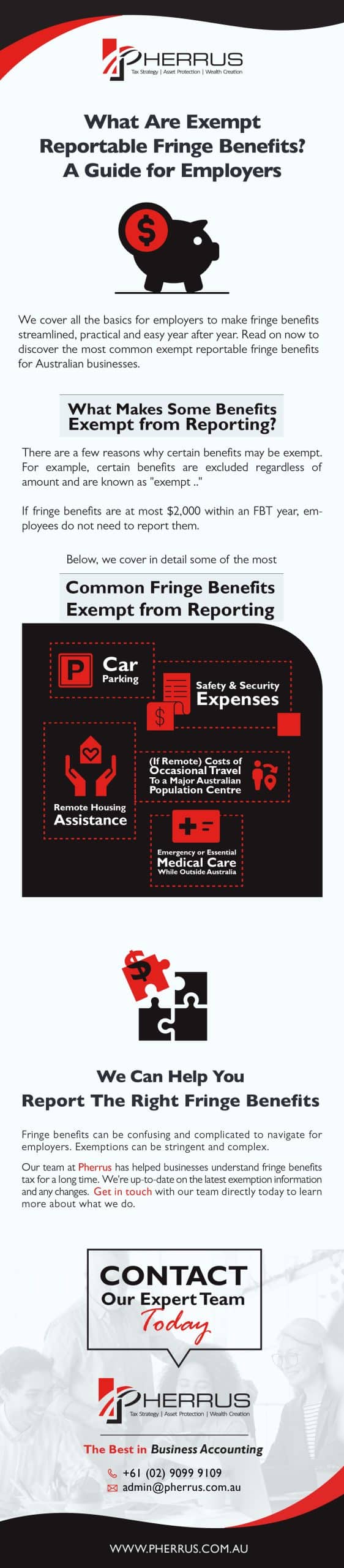

For example, certain benefits are excluded regardless of amount and are known as “exempt ..” If fringe benefits are at most $2,000 within an FBT year, employees do not need to report them. Below, we cover in detail some of the most common exemptions below.

Common Fringe Benefits Exempt from Reporting

While many fringe benefits require the payment of fringe benefits tax, there are several exemptions to this rule, both for employees working in Australia and for those working overseas temporarily.

You can find a full breakdown of different exemptions available on the ATO website, but some of the most common you may encounter include:

Car Parking

Employer-provided car parking is one of the most common fringe benefits within what is exempt from being reported as a fringe benefits. However, there are a few stipulations to this.

Car parking is a fringe benefit if it meets all of the ATO’s rules, which includes parking on property that the employer owns or rents. You can find the full list of conditions here.

Exemptions apply if not all of these conditions are satisfied, with additional exemptions for small businesses and certain institutions such as education, research, or religious organisations.

Remote Housing Assistance

Remote housing assistance is a standard exempt fringe benefit when considering ‘what are exempt remote spring benefits?” It provides a way to cover certain housing costs for workers living or working in remote parts of Australia.

These tax breaks apply to housing provided by an employer, housing assistance for property found by an employee, and costs related to housing and safe transportation. This exemption covers home ownership schemes and repurchase schemes in some cases.

(If Remote) Costs of Occasional Travel To a Major Australian Population Centre

Alongside costs for living remotely, fringe benefits tax is also exempt in cases where remote employees need to travel to major Australian centers for work purposes, in addition to travel for holidays in some cases.

This is more of a one-time expense than a regular part of the job. When thinking about “what is the reportable fringe benefit exempt amount?” it’s important to consider the frequency of travel.

Fly-in/fly-out arrangements for employees to a wide range of places outside of Australia can also be thought of as exempt.

Safety & Security Expenses

Safety and security costs are any benefits you give your employees to make sure they are safe while they work for you.

In the context of a job, this could mean anything from sending a security guard with them to a dangerous place to putting up a security system in their temporary housing.

Exclusions also apply to personal protective equipment and vehicle modifications that provide additional protection.

It’s worth noting that these benefits must be consistent with a threat assessment, and should address an existing security concern for an employee or their associate (such as a relative) to be exempt.

Emergency or Essential Medical Care While Outside Australia

If you have employees who travel outside of Australia for work purposes, any emergency or essential medical care that you cover may be exempt from taxation as part of their fringe benefits.

This applies to situations where the employer can’t use Medicare benefits to cover their care. For instance, if your employee falls ill overseas and you cover their treatment as a benefit, most of these costs will be exempt until they return to Australia.

At which point different benefits apply or they are covered by Medicare. Also, FBT doesn’t apply to the cost of getting an employee to a doctor, either inside or outside the country.

We Can Help You Report The Right Fringe Benefits

Fringe benefits can be confusing and complicated to navigate for employers. Exemptions can be stringent and complex, particularly when figuring out which areas are exempt, whether thresholds are passed, or if you meet certain conditions.

Working with a trained and qualified accountant who understands what is reportable fringe benefits (non-exempt amount) and what is not is beneficial in terms of saving you time, money, and stress.

Non-profits and smaller businesses may also have different needs, which makes the process even more complicated and requires the help of a professional.

Our team at Pherrus has helped businesses understand fringe benefits tax for a long time. We’re up-to-date on the latest exemption information and any changes, ensuring your taxes are on point every year.

Get in touch with our team directly today to learn more about what we do. We’d be glad to help you figure out which exemptions are right for your business. Fill out our contact form online now or call us to get started.