Are you ready to unlock the door to your entrepreneurial dreams and buy a business? The key is the right loan.

The loan you choose will significantly affect the success of your new venture and your financial future.

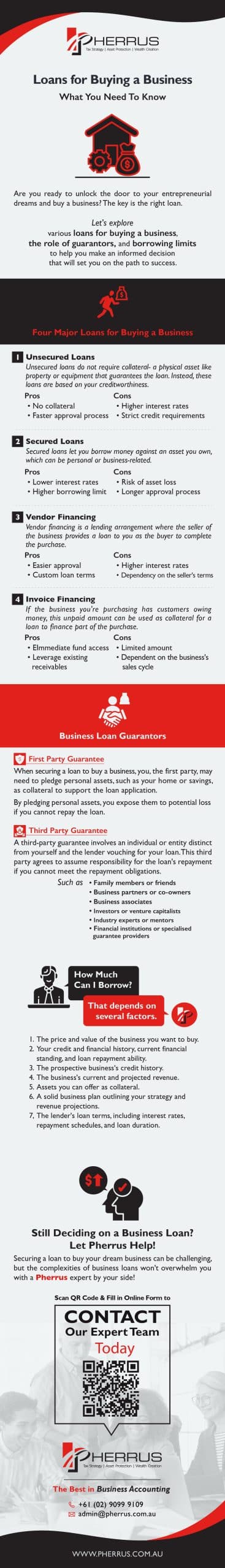

So, let’s explore various loans for buying a business, the role of guarantors, and borrowing limits to help you make an informed decision that will set you on the path to success.

Different Types of Business Loans

The world of business loans in Australia is as diverse as the businesses themselves.

Whether you’re taking over a cosy café or a booming tech startup, there will be a loan option best suited to your endeavour.

The right loan should align with your business size, purpose, and strategy to support your immediate goals and ensure long-term financial stability.

Now, let’s look at four major loans for buying a business to see which could be the game-changer in funding your new business venture.

Unsecured Loans

Unsecured loans do not require collateral– a physical asset like property or equipment that guarantees the loan.

Instead, these loans are based on your creditworthiness.

Pros:

- No collateral. This is Ideal if you don’t have substantial assets or prefer not to risk them.

- Faster approval process. Generally, these loans can be approved faster than secured loans, as there’s no need to evaluate collateral.

Cons:

- Higher interest rates. Unsecured loans often have higher interest rates to offset the lender’s risk.

- Strict credit requirements. This loan option demands a strong credit history, making it less accessible for those with poor credit scores.

Secured Loans

Secured loans let you borrow money against an asset you own, which can be personal (like your home or car) or business-related (such as company property or equipment).

These assets act as collateral for the loan, allowing the lender to recover the loan amount if you can’t make the payments.

Pros:

- Lower interest rates. Since the loan is backed by collateral, lenders usually offer lower interest rates than unsecured loans.

- Higher borrowing limit. You can often borrow more money with a secured loan, as the risk to the lender is reduced.

Cons:

- Risk of asset loss. If you can’t repay the loan, the lender has the right to seize the collateral.

- Longer approval process. The process of valuing collateral can extend the loan approval time.

Vendor Financing

Vendor financing is a lending arrangement where the seller of the business provides a loan to you as the buyer to complete the purchase.

This loan option can be ideal if you’re unable to secure traditional financing.

Pros:

- Easier approval. Since the seller has a vested interest in selling, they’ll likely be more flexible than traditional lenders regarding credit requirements and down payment amounts.

- Custom loan terms: The repayment terms are often more tailored to suit both parties, unlike rigid bank loan structures.

Cons:

- Higher interest rates. Individual sellers don’t have the same resources as banks to absorb losses if the buyer fails to repay, so they’ll charge higher interest rates to compensate for this risk.

- Dependency on the seller’s terms: The seller’s conditions may include shorter repayment periods or set conditions that restrict your business operations. These loan terms might not be as accommodating as those of a traditional bank loan, which offers more flexibility and longer repayment terms.

Invoice Financing

If the business you’re purchasing has customers owing money, this unpaid amount can be used as collateral for a loan to finance part of the purchase.

Invoice financing provides quick access to cash by advancing the money you expect to receive from those unpaid invoices.

You’re essentially getting paid early for work the business has done, and the financing company will collect the payments from your customers when they’re due.

It’s important to note that invoice financing is usually more suitable for supplementing other funding sources, as it’s limited by the value of outstanding invoices, which may not cover the entire purchase price of the business.

Pros:

- Immediate fund access. The advanced cash is useful for imminent expenses related to the business purchase.

- Leverage existing receivables. Utilises the existing financial strength of the business you’re buying, making it easier to secure additional financing.

Cons:

- Limited amount. The amount you can borrow is limited to the value of the outstanding invoices.

- Dependent on the business’s sales cycle. The effectiveness of this borrowing method relies on the business’s sales and invoicing cycle; irregular or long-term invoicing can affect the availability of funds.

- Risk if customers don’t pay. If the business’s customers fail to pay their invoices, it can impact your ability to repay the loan.

Business Loan Guarantors

First Party Guarantee

When securing a loan to buy a business, you, the first party, may need to pledge personal assets, such as your home or savings, as collateral to support the loan application.

Lenders may request a first-party guarantee to reduce lending risk if the business you’re acquiring is relatively new, lacks a substantial financial history, or does not have sufficient assets to cover the loan amount.

It’s vital to understand the associated risks of first-party guarantee.

By pledging personal assets, you expose them to potential loss if you cannot repay the loan.

So, take into account your confidence in the business’s success and ability to repay the loan.

Third Party Guarantee

A third-party guarantee involves an individual or entity distinct from yourself and the lender vouching for your loan.

This third party agrees to assume responsibility for the loan’s repayment if you cannot meet the repayment obligations.

Candidates include those with faith in your capabilities as the prospective business owner or a vested interest in the business’s success, such as

- Family members or friends

- Business partners or co-owners

- Business associates

- Investors or venture capitalists

- Industry experts or mentors

- Financial institutions or specialised guarantee providers

Consider using a third-party guarantor with strong financial standing to improve the loan application’s chances if you lack sufficient personal assets to offer as collateral or if your creditworthiness is a concern.

Additionally, new businesses or those considered high-risk by lenders might require a third-party guarantee to mitigate the perceived risk.

Acting as a third-party guarantor involves substantial risks and responsibilities.

If you cannot repay the loan, they become legally responsible for repaying it in full. Defaulting on the loan as a guarantor can also negatively affect their credit history.

These risks can strain the relationship between you and the guarantor, especially if they’re a family member, friend, business partner, or associate.

So, both parties must understand the responsibilities and consequences involved.

If your guarantor is an investor, financial institution, or specialised guarantee provider, the risks to you include potential conflicts of interest, restrictions on business decisions, and the ability to make independent financial choices.

How Much Can I Borrow?

That depends on several factors.

- The price and value of the business you want to buy.

- Your credit and financial history, current financial standing, and loan repayment ability.

- The prospective business’s credit history.

- The business’s current and projected revenue.

- Assets you can offer as collateral.

- A solid business plan outlining your strategy and revenue projections.

- The lender’s loan terms, including interest rates, repayment schedules, and loan duration.

Many small business loans can be secured by the equity of a property asset.

Equity is the part of the property’s value that you truly own, which is the current property value minus any amount you still owe on a mortgage or loan.

For example, if your house is worth $900,000, and you’ve paid $100,000 of your mortgage, the equity equals $800,000 ($900,000 – $100,000).

The amount you can borrow using equity as collateral depends on the property type (residential, commercial, rural) and the loan-to-equity ratio the lender offers.

This ratio measures how much money you can borrow compared to the value of the assets you own.

How much will a bank lend against equity?

- 80% of a residential property value

- 60-70% of a commercial property value

- 50-70% of a rural property value

Keep in mind that these figures are general guidelines, and actual loan amounts can vary depending on individual circumstances and lender policies.

Still Deciding on a Business Loan? Let Pherrus Help!

Securing a loan to buy your dream business can be challenging, but the team at Pherrus is here to assist you every step of the way.

Our experienced accountants specialise in finance solutions to make your loan application process smoother and more successful.

How?

By suggesting the best available loans for buying a business and walking you through the ins and outs of their structures.

We’ll also explain the loan terms and conditions so you understand everything before signing on the dotted line.

The complexities of business loans won’t overwhelm you with a Pherrus expert by your side!

Fill out our online form or call +61 (02) 9099 9109 to book an appointment at our Bella Vista office in Sydney, NSW.