An investment property can help build serious wealth, but if you don’t manage the tax side properly, you could end up handing over more cash to the ATO than you need to.

If you’re confused about how much tax you’ll pay on your investment property, you’re not alone.

From rental income to capital gains tax, many Aussie investors get caught off guard, missing out on legal deductions or facing tax bills they didn’t see coming.

We’re here to clear things up. We’ll cover

- Rental income tax and what counts as income

- Capital gains tax (CGT) when you sell

- How to use ATO tools to stay compliant

- Common tax mistakes property investors make

- Smart, legal strategies to reduce the tax you pay

Our aim is to help you understand what to expect when it comes to tax on your investment property and how to keep more of your money.

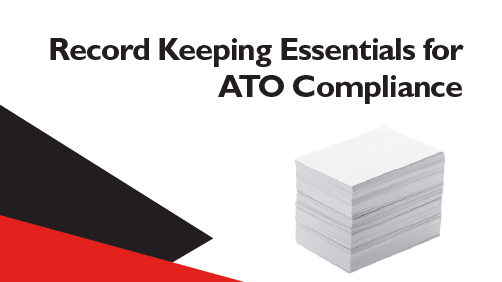

Understanding Tax on Investment Properties

You have to pay tax on the income you earn while you own the property and on the profit you make when you sell it.

Rental income is added to your regular income and taxed at your marginal tax rate.

You can claim certain property-related expenses as deductions, which can reduce the amount of tax you pay.

When you sell, capital gains tax (CGT) may apply to any profit you make.

Understanding these obligations is essential to avoid overpaying taxes or missing out on legitimate deductions. Let’s take a closer look at each obligation.

Rental Income Tax: What You Need to Know

What the ATO Considers Rental Income

If you earn money from renting out a property—including short-term stays like Airbnb—that income is taxable.

The ATO classifies it as assessable income, which means you must declare it in your tax return.

Even if your tenant pays in cash, it still counts! All rental income must be declared, no matter how it’s received.

If you keep any part of the rental bond to cover damage or unpaid rent, that amount is also taxable.

Payouts from landlord insurance can also be considered income. If you receive a payout for lost rent, you need to declare it.

However, insurance payouts for things like repairs usually just reduce your repair deduction and aren’t taxed directly.

Reimbursements from tenants count too.

For example, if you pay for a water bill and claim it as a deduction, but the tenant later pays you back, that reimbursement is considered income.

But if the tenant pays the bill directly, it’s not your income and doesn’t need to be reported.

How Rental Income Is Taxed

Your net rental income (total rental income minus allowable deductions) is added to your other income sources, such as your salary.

The combined amount is then taxed according to your marginal tax rate.

You can check out the tax rates in Australia here.

Example:

$90,000 salary + $32,000 net rental income = $122,000 total taxable income

Taxable income of $45,001 to $135,000 is taxed at $4,288 plus 30c for each $1 over $45,000

Tax due on a total taxable income of $122,000:

-

- Taxable income up to $18,200 is tax-free

- Taxable income from $18,201 to $45,000 is taxed at 16%

- $45,000 − $18,200 = $26,800

- $26,800 × 16% = $4,28

- Taxable income from $45,001 to $122,000 is taxed at 30%

- $122,000 − $45,000 = $77,000

- $77,000 × 30% = $23,100

Total tax payable:

$4,288 (from the second tax bracket) + $23,100 (from the third tax bracket) = $27,388

What Deductions Are Allowed?

You can claim various tax deductions to reduce your taxable rental income.

These deductions cover many ongoing costs of managing and maintaining your investment property.

- Loan interest on the money borrowed to buy the property

- Repairs and maintenance (like fixing a leaking tap or patching up a wall)

- Council rates and water charges

- Property management fees

- Landlord insurance

- Strata fees if your property is part of a complex

Repairs and maintenance are usually deductible in the year you pay for them, while capital works deductions are added to your property’s cost base or depreciated over time.

Capital Works Deductions

Capital works refer to structural improvements to your investment property.

These aren’t minor repairs but significant, long-term upgrades or construction work that adds value to the property.

- Building a new room or extension

- Renovating a kitchen or bathroom

- Replacing a roof

- Adding a fence

- Installing retaining walls or driveways

You cannot claim the full cost of capital works in the same year you paid for them.

They’re either added to your property’s cost base—the total amount you’ve spent on the property—or claimed gradually as a depreciation expense.

Adding capital works to your cost base helps reduce the CGT you might owe when you sell the property.

If you choose to claim the works over time—a method known as capital works deductions—you can usually claim 2.5% per year over 40 years from when the construction was completed.

So, if you spent $100,000 on eligible works, you could claim $2,500 each year for 40 years.

The deduction rate can vary depending on specific factors.

- Date of Construction: For residential properties where construction commenced after 15 September 1987, the standard deduction rate is 2.5%.

- Build-to-Rent Developments: As of January 2025, new incentives have been introduced for eligible build-to-rent developments, increasing the capital works deduction rate from 2.5% to 4%, thereby shortening the depreciation period from 40 to 25 years.

You’ll need a tax depreciation schedule to make capital works deduction claims.

This detailed report outlines what you can claim each year for capital works and plant and equipment (certain removable appliances and fixtures).

Getting a qualified quantity surveyor to prepare this schedule is strongly recommended.

They will inspect your property, estimate construction costs, and identify all claimable deductions in line with ATO rules.

Capital Gains Tax: When You Sell the Property

What Triggers CGT?

CGT is a tax you may need to pay when you dispose of your investment property for more than you originally paid.

The profit you make from the sale is a capital gain, and you must add it to your taxable income for the year.

Even if you reinvest the sale profits into a new investment property, CGT still applies.

The ATO treats certain non-sale events as if you had sold the property.

CGT applies if the property’s market value at the time of the event is higher than what you originally paid, even though no money changed hands.

Such events include

- Gifting the property to someone

- Transferring ownership (even to a family member)

- Swapping the property for another asset

- Passing away

Calculating Your Capital Gain

To calculate your capital gain, subtract your cost base from the amount you received when you sold the property.

That equation looks like this: Sale Price – Cost Base = Capital Gain.

The cost base includes what you paid to buy, hold, and improve the property.

- Purchase price of the property

- Stamp duty on the purchase

- Legal fees related to the purchase or sale

- Agent’s commission when selling

- Renovations that add value to the property

- Borrowing costs (loan establishment fees or title search fees)

Who Gets the 50% CGT Discount?

If you’ve owned your investment property for at least 12 months before the CGT event (usually the contract date of sale), you may be eligible for the 50% CGT discount.

You will only have to pay tax on half of the capital gain you make when you sell the property.

You don’t need to apply for the discount; it’s applied when calculating your net capital gain in your tax return.

Estimate Your Tax with ATO Tools

The Capital Gains Tax Record Keeping Tool helps you calculate your capital gain or loss and keep records of your CGT assets and events.

You can access it through your myGov account linked to the ATO.

The Rental Property Worksheet assists in manually determining your net rental income or loss by listing your rental income and deductible expenses to arrive at your net result.

Keep in mind that these tools give you estimates; they don’t replace personalised tax advice from a tax professional.

Common Mistakes Property Investors Make

Overclaiming or Misclassifying Deductions

You cannot claim private expenses, like upgrading your home or using your investment property for personal holidays.

Even if the expense relates to the property, it’s not deductible if it’s not strictly for income-producing purposes.

Another area where people often slip up is confusing repairs with renovations.

Misclassifying these can lead to incorrect claims and potential issues with the ATO.

Repairs and maintenance—fixing a leaking tap, repainting a wall, or replacing broken tiles—are usually deductible in the year you incur the cost.

Renovations and improvements—upgrading a kitchen, installing new flooring, or adding a deck—are not immediately deductible.

These are capital works, and you must claim these deductions over time through depreciation.

Forgetting to Declare All Income

Many investors unintentionally miss less obvious sources of income, such as retained bond money to cover damage or unpaid rent and short-term rental income from platforms like Airbnb and Stayz.

The ATO treats short-term rent the same as regular rent. It is assessable income, and you must report it on your tax return.

The ATO uses data-matching technology to cross-check information from short-term stay platforms and bank and real estate records, so if you don’t declare all your rental income, they’ll likely find out!

Selling Too Soon and Losing the CGT Discount

If you sell your investment property within 12 months of owning it, you won’t qualify for the 50% CGT discount and will have to pay tax on the entire capital gain.

Poor Record-Keeping

The ATO requires proof of all income and expenses related to your investment property.

Without valid records, you risk missing out on legitimate deductions, overpaying taxes, and facing penalties if you’re audited and can’t support your claims.

Record Keeping Essentials for ATO Compliance

Be sure to keep

- Receipts for property-related purchases, repairs, maintenance, and capital improvements (renovations or upgrades)

- Invoices for property management and accounting services

- Contracts related to the purchase, sale, or leasing of the property

- Bank statements showing rental income and property-related expenses

- Loan statements showing the interest charged on your investment loan

- Depreciation reports prepared by a quantity surveyor

You must keep these records for at least five years from the date you lodge your tax return.

If you carry forward a capital loss or hold the property long-term, you may need to keep related records for up to seven years.

To make things easier in the event of an ATO review or audit, store your records digitally in cloud storage, your accounting software, or a secure folder with clear file names and dates.

5 Legal Ways to Reduce Your Investment Property Tax

1. Time the Sale Strategically

If you’ve owned the property for over 12 months, you may be eligible for the 50% CGT discount. Waiting until the 12-month mark before selling can make a big difference to your final tax bill.

You can also reduce your CGT by selling in a year when your overall income is lower—like during a career break, retirement, or reduced work hours—so less of your gain is taxed at higher rates.

2. Maximise Deductible Expenses

Claim all allowable expenses, including loan interest, repairs, management fees, insurance, and depreciation.

A tax depreciation schedule prepared by a quantity surveyor can help you identify long-term deductions you’re entitled to claim, plus the surveyor’s fees are also a deductible expense!

You can also prepay the following year’s insurance or loan interest (up to 12 months in advance) to bring forward those deductions into the current financial year.

3. Offset Capital Gains With Capital Losses

If you’ve sold other assets like shares or another property at a loss, you can use those capital losses to reduce the capital gain made on your investment property, lowering your overall CGT liability.

4. Consider Joint Ownership

Owning the property jointly with a spouse or partner can allow income and capital gains to be split, potentially reducing the total tax payable if one partner is on a lower marginal tax rate.

5. Review Ownership Structures With a Tax Professional

The right ownership structure can offer significant tax advantages.

Buying an investment property through a trust, company, or self-managed super fund (SMSF) may allow you to

- Distribute income more flexibly (in a trust) to lower-income beneficiaries.

- Cap tax rates (e.g. companies pay a flat rate, which may be lower than your personal rate).

- Access concessional tax treatment inside an SMSF, especially in the retirement phase.

- Protect assets from personal liability.

These structures have strict ATO rules, ongoing costs, and administrative obligations.

Always get tailored advice from a tax professional before setting up or changing your ownership structure to make sure it suits your financial goals and complies with tax laws.

Before You Buy or Sell: Plan for the Tax Impact

Forecast the After-Tax Outcome

Whether you’re buying or selling an investment property, use a simple spreadsheet or an online ATO tax calculator to estimate your likely cash flow, deductions, rental income, and any CGT.

Doing so will help you see how much you’ll pocket or need to pay after tax.

Don’t make assumptions based on rough figures or past performance. Instead, run the numbers first to understand the real impact on your finances.

Factoring in tax from the start can mean avoiding surprises and making more profitable decisions.

Speak to a Property Tax Specialist

Before making any big moves, it’s worth speaking to a property-savvy accountant or tax adviser.

They can help you identify deductions you might miss, suggest better ownership structures, and flag any decisions that could lead to unnecessary tax or compliance issues.

Such advice is especially valuable if you own multiple investment properties or plan to expand your portfolio.

A property tax specialist can help you time transactions, manage capital gains, and structure your investments for long-term tax efficiency.

Take Control of Your Property Tax with Pherrus

How much tax do you pay on an investment property?

It depends on how you buy, hold, claim, and sell your property.

Getting the right tax and accounting advice early on can save you big money and prevent expensive mistakes.

The financial and taxation experts at Pherrus can help you take advantage of deductions and implement strategies to lower your property tax obligations.

We can also manage your property accounting needs so you can focus on growing your portfolio.

Fill out our online form or call (02) 9099 9109 to book your free consultation today.

FAQs About “How Much Tax Do You Pay on an Investment Property?”

Do You Pay Tax on Investment Property in Australia?

Yes. Rental income from an investment property is added to your taxable income and taxed at your marginal rate.

When you sell the property, any profit (capital gain) is also taxed.

How Do I Avoid Capital Gains Tax on Investment Property in Australia?

While it’s challenging to avoid Capital Gains Tax (CGT) on an investment property, you can reduce it by

- Holding the property for over 12 months and qualifying for the 50% CGT discount.

- Using capital losses from other investments to reduce your taxable capital gain.

- Utilising the main residence CGT exemption if the property was your primary residence before becoming an investment.

How Much Is Land Tax on an Investment Property in Australia?

Land tax on investment properties varies by state and territory in Australia.

Generally, land tax is calculated based on the combined unimproved value of all taxable land you own within a state or territory, excluding your principal residence.

Land tax applies if the total value exceeds the state’s tax-free threshold.