Good accountants are essential to any business, and it is important to know how much they cost.

Not all accountants are created equal, so you need to do your due diligence to find one that offers great value for their services.

Accountants can vary in price depending on the type of accountant you need.

There are many different types of accountants, such as small business accountants, tax accountants, and bookkeepers.

You may recall when engaged with your first accountant to complete your end-of-financial-year (EOFY) tax return.

Up until then you may have been using a franchise tax chain and you weren’t happy with your last refund.

So now, after getting a recommendation from a friend, you may be moving on.

Therefore, it’s important to note that various accountants charge differently.

As such, there’s no one straight answer to how much does an accountant cost.

However, there are some things to note; A small business accountant is just what it sounds like – an accountant that specialises in helping small businesses grow and thrive by providing them with financial advice and tax services.

As a result, this type of accountant will likely charge a higher fee than a general accounting firm because they specialise in this niche.

Whereas a tax accountant is someone who specialises in taxes – they do not help with other financial issues or other aspects of running a business or personal finances.

Tax accountants charge more because their expertise is limited to the field of taxes.

Examples of different forms of accountant charge out rates (however, these are not set in stone):

• Chartered accountant fees generally range from $150 per hour to $500 per hour.

• Bookkeepers can charge anywhere from $50-200 per hour.

• Most small business accountant fees are between $75 and $200 per hour.

• Larger businesses with extensive tax needs may cost as much as $2,000.

• Tax accountants can charge anywhere from $100 – $1000 depending on the complexity of taxes and the size of the return.

Should Small Business Owners Hire an Accountant

The short answer is yes. Accountants are an integral part of any business.

They are responsible for the financial aspects of the business.

They help with tax returns, payroll, and other accounting tasks.

But perhaps most importantly, a specialised small-business accountant will not only perform the aforementioned tasks but can help your business survive and thrive.

A talented and skillful small business accountant can punch your numbers, analyse the data and see the bigger picture.

As a result, they can advise you on things like:

• Where you are bleeding money

• Where you can cut down on costs

• Opportunities to increase revenue and profit

• Ways to increase your tax returns

The cost of hiring an accountant will depend on the type of service that you need from them.

A small business accountant will be cheaper than a full-time accountant because they only work on your account when needed.

There are several other pros of hiring an accountant. A few areas to consider:

– Time saved: You can try and do it all yourself, but wouldn’t your time be better spent running your business. Delegating to the pros will save you time and money.

– Cost: Continuing from the last point, in the long run, it will be cheaper to hire a pro than by doing it yourself. Additionally, a good accountant will save your business money.

– Accuracy of accounting: Don’t leave anything to error and risk the wrath of the taxman. A professional accountant leaves no stone unturned.

– Knowledge of tax codes and laws: The tax system is a complicated beast, especially when it comes to running a small business. Gain priceless peace of mind by letting a pro handle it who knows rules and regulations inside out.

Of course, there are many different accountants to choose from which means you can find one that matches your needs and budget.

Types of Accountants

Generally, accounting is a profession that deals with the measurement, disclosure, and reporting of financial information such as income and expenses.

They can also provide advice on financial decisions like how to invest money or what kind of business to start.

They come in all shapes and sizes.

Therefore, the cost of an accountant depends on the type of accountant you need and your location.

Let’s take a look at the different types of accountants.

General Accountant

A general accountant is a professional who is responsible for the financial records of a business or organisation.

They are also involved in tax preparation, payroll, and budgeting.

The cost of an accountant varies depending on the type of work they do.

A small business accountant may charge more than a tax accountant because they are more likely to have more experience with the specific needs of small businesses.

A bookkeeper will usually charge less than an accountant because they only do some accounting tasks.

Tax Accountant

A tax accountant is a professional who is responsible for the preparation of tax returns, the examination of financial records, and the advising of clients on tax matters.

The cost of an accountant can vary depending on their experience and expertise.

Payroll accountant

A payroll accountant is a professional who handles the payroll and tax calculations for a company.

They use software and manual labour to produce paycheques, calculate taxes, withholdings, superannuation plans, superannuation contributions, unemployment insurance premiums, worker’s compensation insurance premiums, and other employee deductions.

Quality payroll accountants are necessary for any business that employs staff and in Australia, there are over 100,000 payroll accountants that work in various industries such as manufacturing, healthcare services or finance.

This number is expected to grow by 11% over the next decade.

Bookkeeper

A bookkeeper is a person who oversees the finances of a company.

They are responsible for making sure that all of the money is accounted for and properly distributed.

A bookkeeper works with the company’s accountant to ensure that financial records are accurate and up-to-date.

They also take care of payroll, taxes, and general accounting tasks.

Bookkeepers have an important role in any small business because they keep track of all the money coming in and out of the company.

What Factors into the Pricing of an Accountant

The cost of an accountant will depend on the type of service they provide. For example, a payroll accountant will cost more than a small business accountant.

Accountants are trained in different areas of expertise, which is why their prices vary.

A general accountant would charge less than a bookkeeper because they do not specialise in bookkeeping and instead focus on taxes and business management.

Other factors that will come into play for the pricing of an accountant are:

– Experience: What’s their experience? How’d their track record? Do they have many (if any) positive reviews online of testimonials? Who have they worked with and how was the outcome?

– Training: What are their qualifications? Are they professional educated? Where did they study and did they graduate? Make sure you are not hiring a self-educated cowboy.

– Resources: What resources do they have access to? Do they possess everything you need to have the job done properly?

– Location: Where are they located? Chances are you will be paying more for an accountant based in Sydney than, say, Humpty Do.

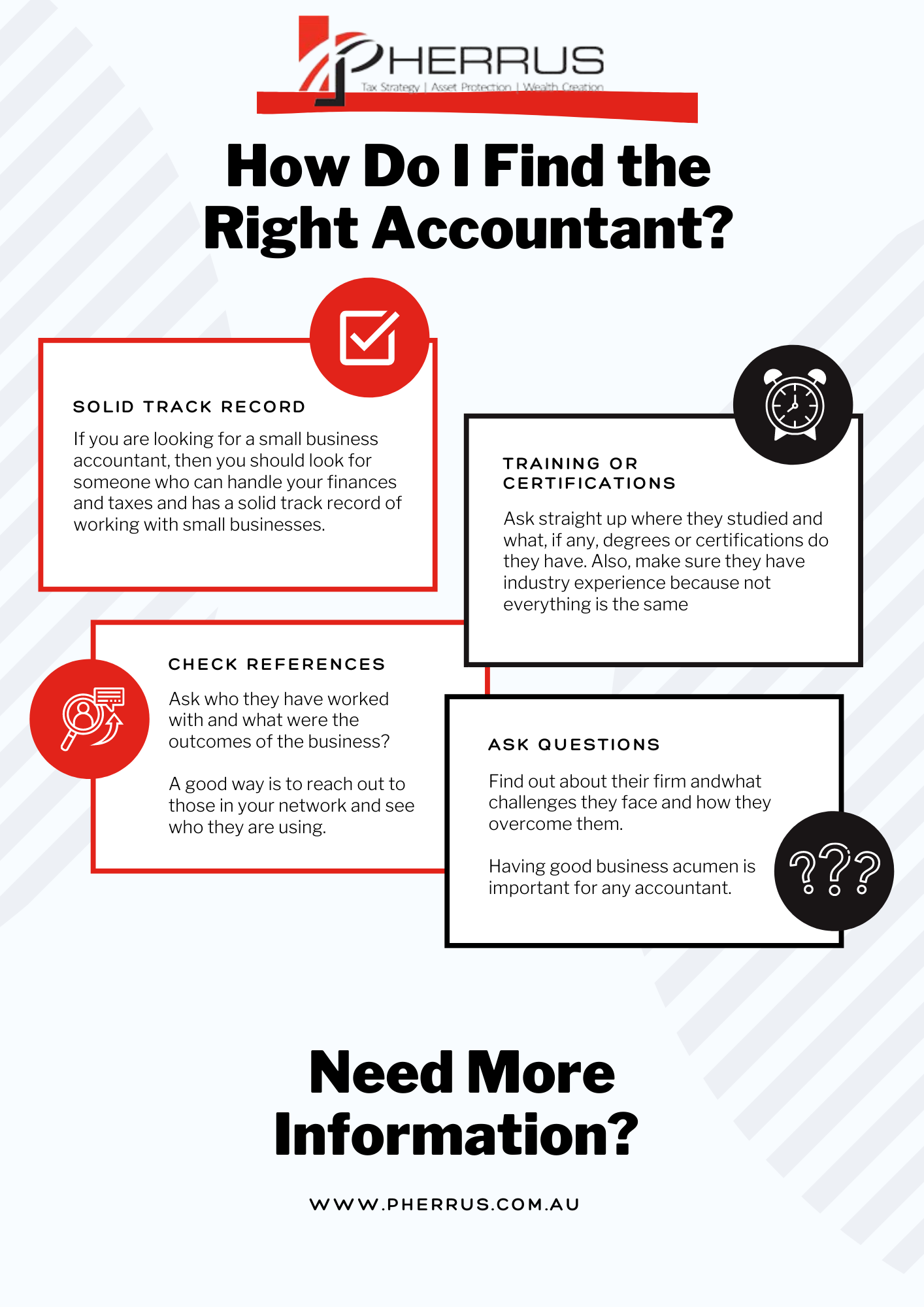

How Do I Find the Right Accountant

Finding the right accountant is not easy. As we say, not all accountants are created equal.

There are so many accountants in the market with different specialities and prices.

If you are looking for a payroll accountant, then you should look for an account that specialises in this area.

If you are looking for a small business accountant, then you should look for someone who can handle your finances and taxes and has a solid track record of working with small businesses.

If possible, ideally you can talk to such a small business to find out whether the account helped them survive and thrive.

Choosing the right accountant is imperative to your small business’s future.

There are certain questions and guidelines you need to consider when doing so.

Don’t be afraid to ask questions about:

– Training or certifications: Ask straight up where they studied and what, if any, degrees or certifications do they have.

– Ask who they have worked with and what were the outcomes of the business?

– Do they have regular, ongoing clients?

– Red flags to look out for: Short permanent roles, large resume gaps, consistently short contracts, no prior experience

Summary

Accountants are an integral part of any successful business. Some accountants specialize in one area, such as payroll or tax accounting.

Others are general accountants who provide a wide range of services to their clients.

The important thing to remember is the cost of an accountant varies depending on the size and needs of the business, but generally speaking, you can expect to pay $50-$100 per hour for a small business accountant and $100-$150 per hour for a general accountant.

If you are currently looking for a small business account, someone who to become an extension of your team and help your business grow, then reach out to us for a friendly and professional service today.