With the federal budget now released, we take a look at the key elements and break them down into an easy to digest summary. We will take a look at :

Tax Advantages

Economic Outlook

Industry Targeted Funding

Let’s begin with the tax advantages.

Tax Advantages

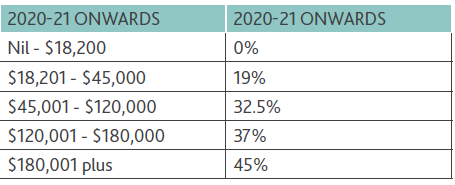

Personal Income Tax Cuts:

- Brought forward effective from 1st July 2020

- Low Middle Income Tax Offset (LMITO) extended for the 2021 Financial Year

- Low Income Tax Offset (LITO) increased from $445.00 to $700.00

Loss Carry-Back for Companies:

- 2020 – 2022 Financial Years, tax losses are able to be used to offset earlier taxable profits

- Limitation to the amount that can be refunded, applicable only to the amount of taxed profits

Note :

Eligible Companies – aggregated turnover of less than $5 billion

Consideration due to the large losses, caused by the application of the instant asset write off

Extension of Apprenticeship Wage Subsidy:

- New Australian Apprentices from 5th October 2020 – 30th September 2021

- Limitation 50% subsidy limited to $7,000 per quarter

- Claims to start from the 1st January 2021

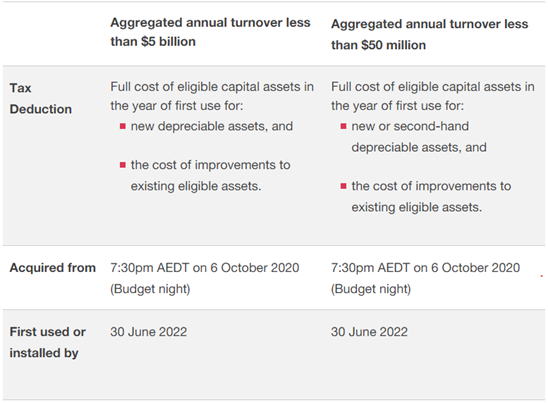

Instant Asset Write Off:

- Complete deduction of newly acquired assets from 6th October 2020 – 30th June 2022

- Extended to businesses with an aggregated annual turnover of less than $5 billion

JobMaker Hiring Credit:

- Introduced from the 7th October 2020 over the next 12 months

- Program to make claims to begin from the 1st February 2021

| Eligible Employees | Amount Receivable |

| Aged 16 to 29 | $200 per week |

| Aged 30 to 35 | $100 per week |

Employee Eligibility :

- Work at least 20 Hours per week

- Employment commenced between 7th October 2020 – 6th October 2021

- Employee received a Centrelink payment for at least one month within the past three months before employment

- Must not also be under the ‘Apprentice Wage Subsidy’

Employer Eligibility :

- ABN

- Up to date tax obligations

- Registered for PAYG Withholding

- Using Single Touch Payroll

- Reference to increase in headcount, based on September 2020 Quarter

- Eligible Employee

- Records of eligible employee employment kept

Ineligible Employer :

- Commonwealth, state and local government operated entities

- Entities in liquidation or bankruptcy

- Employers claiming JobKeeper Payment

- Employers subject to the major bank levy

Research & Development Tax Incentive:

- Introduction in the 2022 Financial Year

Granny Flat CGT Exemption:

- Introduction in the 2022 Financial Year

- Limitation – Condition of application, must be applied to familial ties (Not Commercial)

Extension of Small Business Tax Concessions:

- Aggregated turnover requirement changed from less than $10 million to less than $50 million

- Gradual implementation until the 2022 Financial Year

Economic Outlook

Situational Scenarios :

- Positive – COVID-19 Vaccine

- Negative – COVID-19 Outbreaks

Households :

- Fell by 12.1% in the June 2020 Quarter

- Expected to recover, however to remain slightly lower than pre-COVID-19 levels

Business Investment :

- Fall by 9.5% in the 2021 Financial Year

- Deterioration in non-mining investment – driven by decline in machinery and equipment investment

Public Final Demand :

- Forecast to grow by 5.75% in the 2021 Financial Year

Industry Targeted Funding

Modern Manufacturing Strategy ($1.3 billion):

National Manufacturing Priorities

- Resources Technology & Critical Minerals Processing

- Food & Beverage

- Medical Products

- Recycling & Clean Energy

- Defence

- Space

Modern Manufacturing Initiative

- Manufacturing Collaboration Stream – support business to business and business to research collaboration

- Manufacturing Translation Stream – support manufacturers in translating ideas into commercial products

- Manufacturing Integration Stream – assist with accessing the local and international markets

Infrastructure Investment:

Targets the construction of roads and rail projects

$12.5 billion investment into infrastructure :

- Queensland – $1.3 billion

- New South Wales – $2.7 billion

- Australian Capital Territory – $155.3 million

- Northern Territory – $189.5 million

- South Australia – $625.2 million

- Western Australia – $1.1 billion

- Victoria – $1.1 billion

- Tasmania – $359.6 million

National Programs :

- National Water Grid – $2 billion

- Local Roads & Community Infrastructure – $1 bilion

- Road Safety & Upgrades – $2 billion

Agriculture:

- Agriculture Workforce

- Push to encourage school leavers to undertake agricultural work

- Provide benefits to attract both domestic and foreign workers (Working Holiday Makers)

- Drought

- Infrastructure

- Competition

Housing:

- Aimed to assist first home buyers

Other Targeted Funding:

- Investment in new energy (low emission) technology

- Australian waste management (Recycling)

- Support for regional Australia

- Commonwealth Scientific and Industrial Research Organisation (CSIRO) – supporting scientific research to be applied into commercial activities