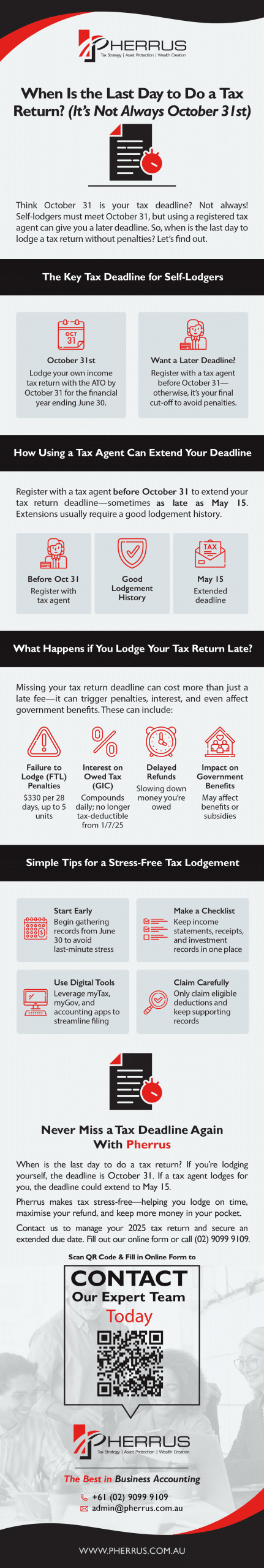

Think October 31st is your tax deadline? Not always!

If you lodge your own return, yes, October 31 is usually the cut-off.

But if you go through a registered tax agent, you might have a much later deadline.

When is the last day to do a tax return to avoid late penalties and stay on the ATO’s good side? Let’s find out.

The Key Tax Deadline for Self-Lodgers

If you’re doing your own income tax return, you need to lodge it with the ATO by October 31.

This deadline applies to the financial year that ended on June 30.

For example, your 2024–25 tax return (covering income and deductions from July 1, 2024 to June 30, 2025) is due by October 31, 2025.

For a later tax deadline, you must be registered with a tax agent before October 31. If not, this is your final cut-off to avoid late penalties.

How Using a Tax Agent Can Extend Your Deadline

Registered tax agents, like the team at Pherrus, have access to a special lodgement program through the ATO.

This program gives Pherrus clients more time to lodge, but only if you’re on our books before October 31.

If you meet that cut-off, your income tax return due date could be extended to as far as May 15th the following year.

The exact date depends on your circumstances and the ATO’s schedule.

Keep in mind, these extended deadlines usually apply if you have a good lodgement history.

If you’ve lodged late in the past or owe significant tax debt, the ATO may still require you to lodge earlier, even with an agent.

What Happens if You Lodge Your Tax Return Late?

If you lodge your income tax return late, the ATO can apply a Failure to Lodge (FTL) penalty, even if you’re entitled to a refund.

The penalty is calculated using units. Each penalty unit is currently worth $330.

For individuals, the ATO adds one unit for every 28 days your return is overdue, up to a maximum of five units.

If you owe tax, the ATO will also charge what’s called the General Interest Charge (GIC).

This interest starts building from the original due date and compounds daily.

For the April to June 2025 quarter, the GIC rate was 11.17% per annum.

And from July 1, 2025, the rules change-GIC will no longer be tax-deductible, which adds another layer of cost to late payments..

Even if you’re not expecting a tax bill, lodging late still hurts.

You’re delaying the ATO from processing your refund, which means you’re putting off receiving money that’s rightfully yours.

There’s also a risk that late lodgement could affect your eligibility for government benefits.

Payments like the Family Tax Benefit or childcare subsidies often rely on up-to-date tax returns to calculate entitlements correctly.

A delay in lodging can cause issues with those payments or result in overpayment recovery later on.

Simple Tips for a Stress-Free Tax Lodgement

- Start Organising Early: Don’t wait until October to start thinking about your tax return. As soon as the financial tax year ends on June 30, begin gathering your records so you’re not rushing at the last minute.

- Create a Document Checklist: Make a list of everything you’ll need, including income statements, bank interest summaries, receipts for work-related deductions, health insurance details, and any investment records. Having all these documents in one place saves time and avoids missed claims.

- Leverage Digital Tools: Use the ATO’s myTax portal or apps like myGov to pre-fill parts of your return. Cloud-based accounting software and receipt tracking apps can also make record-keeping much easier throughout the year.

- Don’t Guess Deductions: Always check what you’re entitled to claim, and keep records to back up your claims. Guessing can lead to audits, penalties, or missed opportunities to claim legitimate expenses. If you’re unsure, seek professional advice from a registered tax agent.

Never Miss a Tax Deadline Again With Pherrus

When is the last day to do a tax return?

If you’re lodging yourself, the deadline is October 31. If a tax agent lodges for you, the deadline could extend to May 15.

Pherrus is your simple solution to deadline stress and the October 31st rush. Let us give you breathing room and peace of mind.

We can help you lodge on time and take advantage of smart tax strategies to maximise your refund and keep more money in your pocket.

Contact us today to manage your 2025 tax return and secure an extended due date. Fill out our online form or call (02) 9099 9109.