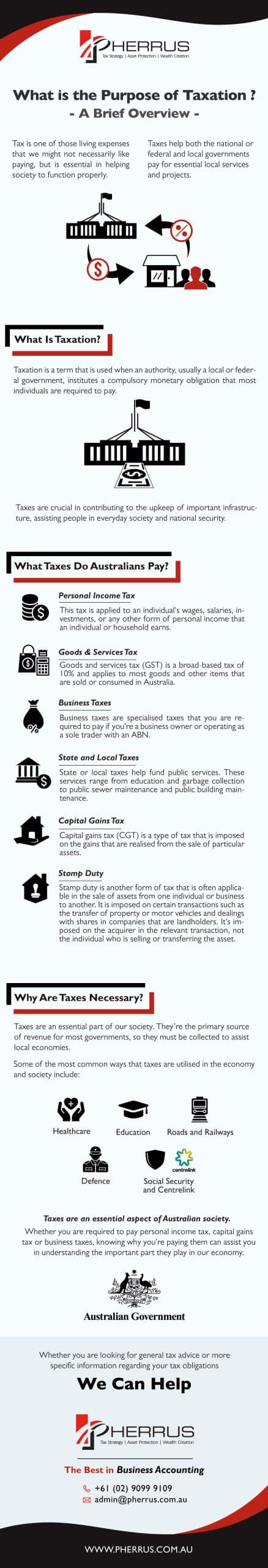

Tax is one of those living expenses that we might not necessarily like paying, but is essential in helping society to function properly.

Taxes help both the national or federal and local governments pay for essential local services and projects.

But, while we all understand the basics of taxes and how they work, knowing what tax is and why taxes are necessary is an important aspect of accepting that they’re an essential part of society.

What is taxation?

Taxation is a term that is used when an authority, usually a local or federal government, institutes a compulsory monetary obligation that most individuals are required to pay.

Paying taxes is not a new phenomenon.

Citizens and residents have been paying taxes to governments or officials for a significant length of time and are considered an essential payment in almost every single country in the world.

Taxation refers to all types of involuntary or compulsory levies that are imposed on both individuals and businesses.

Some of the most common forms of tax are personal income tax, business tax and GST (or Goods and Services Taxes).

The most basic function or reason that taxes are levied is to raise revenue for government expenditures, though it can serve other purposes as well.

These expenditures include sectors such as education, health care, defence and essential infrastructures such as roads or highways.

Taxes are, therefore, crucial in contributing to the upkeep of important infrastructure, assisting people in everyday society and national security.

What taxes do Australians pay?

Taxation is differentiated from other forms of payment, such as market exchanges, in that it’s a compulsory payment and does not require consent.

It’s not directly tied to any services rendered and is instead a levy that everyone must contribute toward for the betterment of society.

Paying taxes is a legal responsibility of every working individual or business; however, there are several different forms of tax that you may be required to pay, depending on your personal income situation, your business and your investment activities.

Knowing what these taxes are is an important aspect of understanding what taxes you are required to pay, and why and how they are calculated.

Some of the most common taxes that you can expect to pay throughout your life include:

Personal income tax

Personal income tax is probably the most common form of tax requirement that everyone will encounter in their working lives.

Personal income tax is often also referred to as individual income tax.

This tax is applied to an individual’s wages, salaries, investments, or any other form of personal income that an individual or household earns.

The tax amount that you pay depends on a variety of different factors, including how much you earn, how many jobs you have, if you are considered a low-income earner or a high-income earner, etc.

There are generally tax brackets that help determine how much you end up paying per tax year.

There are also a number of exemptions, deductions and credits available that can lessen how much tax you pay.

Due to these exemptions or tax breaks, most individuals will not end up paying taxes on all of their income, or they will receive a healthy tax return at the end of the financial year.

The government and tax departments often offer a series of income tax deductions and other tax credits that taxpayers can make use of to reduce their taxable income.

These deductions can help to lower your taxable income, determine the tax rate or bracket that is applied to you, and calculate your overall tax owing amount.

In the event that you have paid more tax than you owe, or you have a number of deductions that you can apply for, you will often qualify for a larger refund of your tax paid throughout the financial year.

Goods & Services tax

You may have noticed on receipts that many of the products and goods that you purchase have a GST section on them, indicating how much GST was applied to a product or your overall purchase amount.

Goods and services tax (GST) is a broad-based tax of 10% and applies to most goods and other items that are sold or consumed in Australia.

Goods and Services tax will often also be applied to services provided to you by other individuals if you are paying for their expertise.

Generally, in Australia, sole traders, businesses and other organisations that are registered for GST will:

Include the amount of GST payable in the price they charge for their goods and services

Claim credits for the GST are included in the price of goods and services they buy for their business.

But, as a business owner, sole trader or other organisation, how do you know if you need to register to pay GST on your products or services?

Generally, if you run a business and have profits of $75,000 or greater ($150,000 or more for non-profit organisations), you are legally required to register for GST.

Often, many businesses will choose to pass this GST cost along to the consumer, which is why you will often see a GST section on your receipt.

Business taxes

Business taxes are specialised taxes that you are required to pay if you’re a business owner or operating as a sole trader with an ABN.

The amount of business tax that your business has to pay will be dependent upon the amount of taxable income that your business generates.

The amount you pay is calculated from your assessable income minus any business deductions that you need to apply.

Business taxes can be incredibly complex in nature and it’s not uncommon for many business owners to keep a licensed accountant on retainer to keep their accounts and tax details up to date to make tax time a much easier and smoother process.

Your business taxes are calculated by determining assessable income, which is generally any income that your business has earned or generated over the past financial year.

This figure includes all gross income from your everyday business activities as well as other income that is not part of your everyday business activities.

This can include profits from services rendered, interest earned on investments and capital gains.

It’s possible to claim tax deductions for certain expenses that are involved in running your business.

Deductions can be things such as the purchase of equipment, the education or training of your employees, everyday expenses involved in the running of your business, and the rental of equipment or premises.

An accountant will be able to determine what is and isn’t considered a deduction and assist you in claiming these against your assessable income.

This can help to significantly lower your tax bill.

You must lodge an income tax return every year you run your business. It’s important to keep your tax lodgements up to date, even if you don’t expect you’ll owe tax.

Business taxes in Australia are administered and collected by the Australian Taxation Office (ATO) and in some cases, local state government revenue offices.

Businesses have the option of paying throughout the year or simply paying a lump sum at the end of the financial year.

However, this will depend upon how much they are earning. Businesses can elect to make tax payments monthly, quarterly or annually, but most businesses will opt for PAYG taxes (Pay As You Go) to help relieve the stress of a large bill come tax time.

Additionally, businesses can save themselves money by paying the correct amount on time and taking advantage of any tax concessions that they are entitled to.

Some of the key taxes affecting businesses are:

• Company (income) tax

• Capital gains tax (CGT)

• Goods and services tax (GST)

State and local taxes

State or local taxes help fund public services.

These services range from education and garbage collection to public sewer maintenance and public building maintenance.

These local taxes can be presented in many forms, from property taxes and payroll taxes to goods and sales taxes on products and services.

They can vary widely from one state to the next, so it pays to look up your local state’s tax laws to see if any of these apply to the area that you live or work in.

Capital gains tax

Capital gains tax (CGT) is a type of tax that is imposed on the gains that are realised from the sale of particular assets.

There are specific rules that are applicable to the valuation of capital gains and how and when they are applied.

A capital gain or a capital loss is defined as the difference between what you initially paid for an asset and the price that you eventually sold it for.

This difference takes into account any other costs on the purchase and sale.

So, as an example, if you sell an asset such as a property for more than you paid for it, that’s a capital gain, as you have made money or income on it. If, on the other hand, you sell it at a loss, this is considered a capital loss as you have lost money.

Capital gains tax usually applies to capital gains you have made when you dispose of or sell an asset.

There are a few exceptions to capital gains rules and when they apply, such as the sale of a family home that you have been living in. Investment property, on the other hand, would have capital gain or loss applied to it.

For taxation purposes, the assets subject to CGT are very broad and include both tangible and intangible assets.

Knowing what applies and being organised is key when trying to calculate and pay your capital gains tax (if applicable).

A quick and easy way to keep up-to-date records is by holding on to:

Initial sale contracts and receipts for expenses

Interest paid on related borrowings

Receipts for ongoing expenses like maintenance or repairs

Expense records

Official valuations, especially if you’re planning on selling soon

Any capital gains or losses that you have been subject to are required to be included in a taxpayer’s assessable income.

Generally, these gains will be added to your income total, meaning that your gains will be taxed at your applicable income tax rate.

Another thing to keep in mind is the fact that if you hold onto the capital asset for more than 1 year, Australian residents are entitled to a 50% discount for taxation purposes.

Any capital losses that are incurred can be used to offset any capital gains you also may have earned

Stamp duty

Stamp duty is another form of tax that is often applicable in the sale of assets from one individual or business to another.

Stamp duty is imposed on certain transactions such as the transfer of property or motor vehicles and dealings with shares in companies that are landholders.

It’s imposed on the acquirer in the relevant transaction, not the individual who is selling or transferring the asset.

One thing to keep in mind is the fact that the imposition of stamp duty is not consistent across states.

Each state in Australia is going to have applicable stamp duty laws and how much the stamp duty is going to be for certain transactions.

While it can generally be imposed at either a fixed rate or at a rate that depends on the value of the transaction, there are instances where it is going to differ or be subject to a certain situation.

Understanding your state’s laws surrounding stamp duty will help you understand how it can impact you if you’re buying or selling large assets

For example, several Australian states impose stamp duty on transfers of land according to a sliding scale.

This sliding scale is dependent on the value of the property and is going to be specific to the home or property being sold.

As a general rule of thumb, the lower the price of the house or asset, the lower the stamp duty fees are going to be.

The cheapest valued properties can often attract stamp duties of around 1.25%.

As properties increase in price, the rate will progressively increase to around 6-7%.

Due to the fact that stamp duty can, and often does vary by state, it’s important to consider stamp duty rules on a state-by-state basis.

Property and other assets such as business assets or vehicles are going to attract stamp duty rates that will likely vary significantly.

Additionally, some transactions may receive concessions or exemptions that may not be applicable in other states or territories.

Why are taxes necessary?

Many people often wonder what the main purpose of taxation is, but taxes are an essential part of our society.

They’re the primary source of revenue for most governments, so they must be collected.

A good tax system raises the revenue that is needed to finance essential government activities without imposing extra unnecessary costs on the economy.

Australia relies heavily on individual and corporate income taxes to finance essential government activities to assist local economies.

These taxes are then spread across a variety of sectors with the aim of positively impacting both economic growth and the everyday lives of Australians.

Wanting to know how and where your tax money is spent by the government is understandable.

It can help you understand why the taxes that you pay are essential and how they are contributing to your quality of life as well as general economic growth.

Taxes are a financial mechanism that allows the government to perform or provide essential services that would not be provided otherwise.

Some of the most common ways that taxes are utilised in the economy and society include:

Healthcare

Medicare is a publicly-funded universal health care insurance scheme in Australia.

It gives you access to a wide range of healthcare services that are already paid for.

Some of the benefits include cheaper prescriptions, free appointments, and specialised health care or procedures.

While not everything is covered under Medicare, it does cover a significant range of medical services that would otherwise be incredibly expensive.

As an Australian resident for tax purposes, you are subject to the Medicare levy.

This Medicare levy helps to ensure that every Australian has access to free health care.

The Medicare levy you are expected to pay is in addition to the tax you pay on your taxable income, although you may qualify for a reduction or exemption from the levy.

You may also be entitled to a rebate if you have a private health insurance policy.

This is known as a private health insurance rebate which is applied at the end of the financial year.

Education

The Australian government contributes to the majority of schooling costs in an attempt to ensure that every child is able to attend school and gain an education.

Part of the taxes that the government collects from you is utilised to help pay for the many costs that are associated with public education, from teachers’ salaries to building maintenance and upkeep.

These taxes also ensure that government schools, also known as public schools, remain free to attend for Australian citizens and permanent residents. Investing in education is key in protecting Australia’s future.

Roads and railways

Having access to good roads and railway lines that are regularly maintained and kept in top condition is another way that your taxes are being spent by the government.

The maintenance and building of roads is an ongoing expense that benefits every Australian citizen or permanent resident.

While some funding is provided by the Australian government and state or territory governments, the vast majority of road and railway maintenance is covered by the taxes or rates that you pay.

Defence

Another important area that your taxes are helping to fund is the Australian Defence forces.

The ADF is in charge of securing Australia’s borders and keeping everyone safe.

Your taxes are going towards the country maintaining a standing defence force that is well trained and able to contribute to world events when and where it needs to.

Many essential activities that Australia’s defence force participates in include search and rescue efforts, supporting allied nations and actively protecting our borders.

With Australia investing a record amount of money into the Department of Defence, part of your taxes is going towards this cost.

Social security and Centrelink

Finally, an incredibly important area that your taxes are helping to fund is social security and Centrelink.

This is a service designed to assist individuals that need financial support by providing certain payments, such as parental leave, job seeker allowance, child care subsidy and much more.

The taxes that every working Australian and permanent resident are expected to pay are key to maintaining this system.

Without social security or Centrelink, there would be many Australians who would be unable to afford to live.

Taxes help to ensure that this is not the case and that everyone gets the support they require.

Summary

Taxes are an essential aspect of Australian society.

Whether you are required to pay personal income tax, capital gains tax or business taxes, knowing why you’re paying them can assist you in understanding the important part they play in our economy.

The taxes that we pay to the government allows our federal and local state governments to provide us with services and facilities that help to better Australia for everyone living here.

From providing publicly funded health care and education to ensuring that public infrastructure such as roads, railways and highways are in top condition, there are many aspects to taxes that we benefit from every single day.

If you’re looking for further information regarding what is the purpose of paying taxes and how they impact you, get in touch (https://www.pherrus.com.au/contact-us/) with our team today.

Whether you are looking for general tax advice or more specific information regarding your tax obligations, we can help.

Our experts will be able to answer any questions that you might have and assist you in getting your tax affairs in order for the new financial year.

For expert tax advice, get in contact with the Pherrus team today.