Unlike the well-known individual tax return deadline of October 31, your company’s tax return deadline can vary.

When are company tax returns due? That depends on your company’s size, tax status, and whether or not you’ve been granted extensions.

Keeping track of due dates can be a hassle with everything else you’ve got going on as a company director.

Pherrus is here to help you stay on top of your compliance obligations and never miss a deadline.

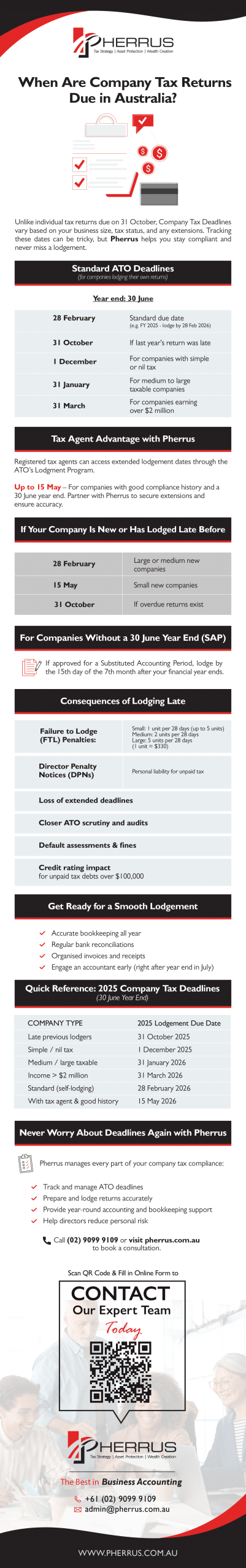

Understanding the Standard ATO Deadlines for Company Tax

A company that prepares its own tax return for a standard financial year ending June 30 needs to lodge it by February 28 of the following year.

For example, for the financial year ending June 30, 2025, a company lodging its own return would need to do so by February 28, 2026.

This deadline applies to a minority of companies, as most engage a registered tax agent, which significantly changes the lodgement due dates.

- October 31: For companies that don’t lodge their return for the previous financial year on time.

- December 1: For companies that don’t have a full tax assessment, meaning they might not owe taxes or their tax situation is simpler.

- January 31: For medium to large businesses that were taxable the prior year.

- March 31: For companies with a total income in the 2023–24 year of more than $2 million.

The Tax Agent Advantage – How Pherrus Can Extend Your Lodgement Date

At Pherrus Financial Services, our team of registered tax agents can help your company access extended lodgement deadlines through the ATO’s Lodgment Program.

This program offers concessional due dates, providing valuable extra time for businesses and their accountants to finalise annual financial statements and prepare a thorough, accurate tax return.

For certain companies that have not been assigned a different due date based on their size, type, or structure, with a financial year ending on June 30 and a good compliance history, the Australian Taxation Office (ATO) may allow an extended lodgement due date of May 15 of the following year.

For example, by partnering with Pherrus for the 2025 financial year, your company’s tax return lodgement deadline could be extended to May 15, 2026.

To take advantage of this and other extended deadlines, you must list your company with a registered tax agent like Pherrus before the lodgement due date.

You must also maintain a good compliance history by consistently lodging your tax returns on time, paying any outstanding taxes by their due dates, and adhering to all relevant tax laws and regulations.

It’s important to note that extended due dates are a concessional arrangement, and failure to lodge on time may result in penalties.

What If Your Company Is New or Has Been Late Lodging Before?

If your newly registered company is considered large or medium in size by the ATO, or is the head company of a larger group of new companies, the deadline for lodging your tax return is February 28 of the following year.

If your new company is a smaller business, which doesn’t fit into the large/medium category, the deadline for lodging your tax return is May 15.

What if your company has missed filing a return in the past and still has overdue returns? Then you’ll need to file by October 31.

For Companies Not Using a June 30 Year End

The ATO approves some companies to use a “substituted accounting period” (SAP), which means their financial year doesn’t end on June 30.

Instead, these companies have a custom year-end that suits their business needs.

The general rule for companies with a substituted accounting period is that their tax return is usually due by the 15th day of the seventh month following the end of their specific financial year.

For example, if a company has a financial year ending on December 31, its tax return is due by July 15 of the following year.

The Consequences of Lodging a Company Tax Return Late

- Failure to Lodge (FTL) Penalties: A penalty is imposed based on your company’s size, with the amount increasing the longer the return is overdue. One penalty unit currently equals $330.

- Small Entities: 1 penalty unit per 28-day period, up to 5 penalty units.

- Medium Entities: 2 penalty units per 28-day period.

- Large Entities: 5 penalty units per 28-day period.

- Director Penalty Notices (DPNs): Directors can become personally liable for unpaid tax debts (e.g., PAYG withholding, superannuation) if returns are not lodged on time.

- Impact on Future Lodgement Deadlines: A poor lodgement history could result in your company losing eligibility for extended tax agent deadlines in future years.

- Closer Scrutiny from the ATO: Companies with a history of late lodgments may face increased scrutiny from the ATO, leading to more audits and follow-up checks.

- Default Assessments: If a tax return is not lodged, the ATO may issue a default assessment, which could include a 75% administrative penalty.

- Audits and Legal Action: Repeated late lodgments can trigger audits, and in severe cases, the ATO may take legal action, leading to fines or even imprisonment.

- Credit Reporting: Overdue tax debts over $100,000 for more than 90 days may be reported to credit bureaus, impacting the company’s credit rating and ability to secure financing.

How to Get Your Company Ready for a Smooth Tax Lodgement

- Diligent Bookkeeping: Keep accurate records throughout the year using reliable accounting software. Doing so will save you time when it’s time to lodge your tax return and ensure your financials are up to date and correct.

- Regular Reconciliation: Reconcile your bank accounts and key balance-sheet accounts regularly to identify discrepancies early on and make sure your company’s financial records align with your actual transactions.

- Organised Records: Keep all invoices, receipts, contracts, and asset registers organised and easily accessible. Having everything in one place streamlines the process for reviewing and submitting financial details for your tax return.

- Enlisting the Help of an Accountant Early: Don’t wait until the last minute! The best time to engage an accountant for year-end work is shortly after the financial year ends in July. Starting the conversation early allows enough time to address any issues and prepare for a smooth lodgement without rushing.

A Quick Reference Guide to 2025 Company Tax Deadlines

For companies with a financial year ending on June 30:

| Lodgement Date | Who Lodges |

| October 31 | Companies that don’t lodge their return for the previous financial year on time |

| December 1 | Companies that may not owe taxes or have a simple tax situation |

| January 31 | Medium to large companies that were taxable in the previous financial year |

| February 28 | Companies preparing their own tax return, newly registered companies that are considered large or medium in size by the ATO, or the head company of a larger group of new companies |

| March 31 | Companies with a total income in the 2023–24 year of more than $2 million |

| May 15 | New smaller companies that don’t fit into the large/medium business category, and certain companies that have not been assigned a different lodgement due date based on their size, type, or structure and are tax agent clients |

These are general dates provided by the ATO and can vary based on individual circumstances and the ATO’s discretion.

Speak to a tax professional for advice tailored to your company’s unique situation.

Never Worry About a Company Tax Deadline Again with Pherrus

When are company tax returns due?

That depends! They could be due anytime during the year, depending on your company’s financial year-end date, whether you’re using a registered tax agent, and if your company has any prior year returns outstanding.

Confused? Pherrus is the solution to the complexity, stress, and risks associated with company tax compliance.

We can

- Manage your ATO deadlines to help you get the latest possible lodgement date.

- Prepare and lodge your company’s annual financial statements and tax return.

- Offer year‑round bookkeeping and accounting support.

- Help you understand and mitigate the personal risks you face as a company director.

Contact the expert team at Pherrus today for a consultation. Fill out our online form or call (02) 9099 9109.

FAQ

When Must a Company Lodge a Tax Return?

A company preparing its own tax return for a standard financial year ending June 30 must lodge it by February 28 of the following year.

Companies that haven’t lodged their return for the previous financial year on time must lodge their current return by October 31.

Companies that don’t have a full tax assessment must lodge by December 1.

Medium to large businesses that were taxable in the previous financial year must lodge by January 31, and companies with a total income in the 2023-24 year of more than $2 million must lodge by March 31.

Does My Company Need to Lodge a Tax Return?

All companies in Australia are required to lodge a tax return annually with the Australian Taxation Office, even if they don’t owe any tax.

How Often Do You Pay Company Tax in Australia?

In Australia, companies typically pay tax quarterly through the Pay As You Go (PAYG) instalment system, based on their expected tax liability.

However, the actual company tax return is lodged annually.