Every business hits that point where spreadsheets aren’t enough.

You need strategy, structure, and someone who gets the story behind the numbers.

A virtual CFO can guide your next move with insight, not guesswork.

What is a virtual CFO? And how exactly can they help your business?

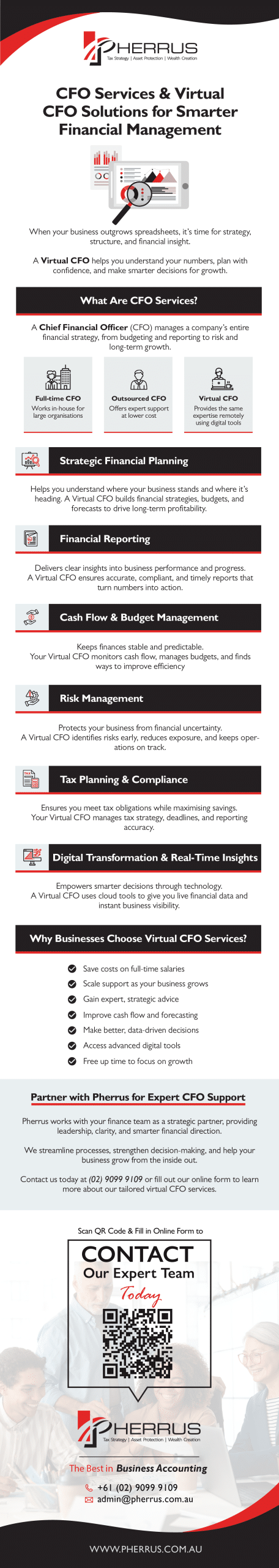

What Are CFO Services?

A Chief Financial Officer (CFO) is the senior executive responsible for managing a company’s finances.

They oversee everything from budgeting and forecasting to financial reporting, cash flow, and long-term strategy.

A CFO doesn’t just track numbers; they interpret them to guide smarter business decisions and sustainable growth.

A full-time CFO works in-house and is part of the company’s leadership team.

They’re ideal for larger organisations with complex financial operations that require constant oversight.

An outsourced CFO offers the same level of expertise on a more flexible, cost-effective basis.

They might work on-site occasionally or remotely, providing support without the high salary or overhead of a full-time executive.

A virtual CFO is a type of outsourced CFO who operates entirely online. They use digital tools to deliver financial management remotely.

What do virtual CFO services typically include?

Strategic Financial Planning for Business Growth

Strategic financial planning helps you see the bigger picture: where your business stands now, where it’s heading, and what resources are needed to get there.

With clear financial direction, you can manage risks, seize opportunities, and make confident decisions.

A virtual CFO assesses financial performance, identifies areas for improvement, and develops strategies that align with your goals.

Through budgeting, financial forecasting, and scenario planning, they help you stay agile in changing markets and build a roadmap for long-term profitability and success.

Financial Reporting

Financial reporting reveals where your money is going, how efficiently your operations run, and whether you’re meeting financial goals.

Financial reports provide the foundation for smarter decisions, investor confidence, and long-term stability.

A virtual CFO manages the entire reporting process, from preparing financial statements to interpreting the results.

They ensure your reports are accurate, compliant, and delivered on time, while turning complex figures into practical insights.

Cash Flow and Budget Management

When you understand where money is coming from and where it’s going, you can plan ahead, meet financial commitments, and avoid unnecessary strain on your operations.

Strong budgeting also helps prioritise spending, maintain stability during slower periods, and support future growth.

A virtual CFO monitors, analyses, and manages your cash flow to keep finances balanced and predictable.

They create detailed budgets, forecast income and expenses, and identify areas to reduce waste or improve efficiency.

Risk Management

Risk management protects your business from financial setbacks and unexpected challenges.

Identifying and addressing risks early helps maintain stability and keeps operations on track.

A virtual CFO assesses potential financial risks, such as cash flow gaps, market shifts, or compliance issues.

They develop strategies to reduce exposure, monitor key indicators, and guide informed decisions that protect your business and support steady growth.

Tax Planning and Compliance

Tax planning and compliance are essential for meeting legal obligations and optimising your financial position.

Staying organised and proactive helps avoid penalties and uncover opportunities for legitimate savings.

A virtual CFO oversees your tax strategy, ensuring reports are accurate and deadlines are met.

They identify deductions, plan for future liabilities, and coordinate with accountants or advisors to keep your business compliant and tax-efficient.

Digital Transformation and Real Time Insights

Digital transformation allows businesses to access financial data instantly, make faster decisions, and stay competitive in a changing market.

Real-time insights improve visibility, helping you respond quickly to performance trends and emerging opportunities.

A virtual CFO uses cloud-based tools and automation to streamline reporting, forecasting, and analysis.

They turn live financial data into actionable insights, giving you a clear picture of your business performance at any moment.

Why Businesses Choose Virtual CFO Services

- Cost Savings: Access senior financial expertise without paying a full-time executive salary or benefits.

- Scalable Support: Adjust the level of service as your business grows.

- Expert Insight: Get strategic advice from professionals who work across multiple industries and understand best practices.

- Improved Cash Flow Management: Gain clarity on where your money’s going and how to optimise spending.

- Better Decision-Making: Use accurate forecasting and data-driven insights to plan for growth and avoid risks.

- Access to Advanced Tools: Benefit from the latest accounting and reporting technologies without managing them in-house.

- More Time for Your Business: Focus on operations and growth while your virtual CFO handles the financial complexity.

- Objective Perspective: Receive unbiased advice from an external expert with a fresh view of your finances.

Is a Virtual CFO Right for Your Business?

A virtual CFO is ideal for small to medium businesses that need expert financial guidance without the expense of a full-time executive.

It’s the perfect middle ground between doing it yourself and hiring in-house.

If your business is growing quickly, facing complex financial decisions, or preparing for investment, it might be time to move beyond ad-hoc financial help.

Upgrading to a full suite of CFO services gives you consistent oversight, detailed forecasting, and proactive strategies that support sustainable growth.

Partner with Pherrus for Expert CFO Support That Drives Growth

Pherrus can work alongside your existing finance team. Think of us as a strategic partner.

We’ll bring leadership, guidance, and clarity to your business’s finances.

Through hands-on training and access to advanced financial tools, we can streamline your processes, strengthen decision-making, and free your people to focus on their work.

It’s collaboration that lifts capability and drives growth from the inside out.

Fill out our online form or call (02) 9099 9109 to speak with our team today about tailored virtual CFO services.