Because one of the most important aspects of your business is your employees, choosing the proper payroll system is critical to ensuring the health and success of your business.

Your payroll system is responsible for making sure your employees are properly compensated for their services, your company remains in compliance with governmental regulations and your internal financial processes are as efficient as possible.

So in this article, we’ll help you understand the different types of payroll systems and decide which one might be the most useful for your company.

What is a payroll system? (+ why you need one)

A payroll system is responsible for organising your company’s payroll and processing it on a weekly, fortnightly or monthly basis to ensure your employees are accurately paid and your governmental obligations are fulfilled.

A payroll system can consist of employees of your company completing the process internally or an outsourced solution where an outside firm completes the task on your company’s behalf.

A large component of a payroll system is a software solution to organise and pay employee wages and calculate and pay payroll taxes.

To learn more about What Is Payroll Tax be sure to checkout our comprehensive guide.

A payroll system can also be integrated to record the hours that employees work, leave entitlements, payroll taxes and other deductions.

A major part of a payroll system is the calculation and payment of payroll taxes.

Payroll taxes are the financial obligations your employees are required to pay to state and territory authorities on the money they earn.

As an employer, you calculate an estimate of those taxes and pay them directly to government authorities on behalf of your employees.

Because of the importance of accuracy in the payroll process, it’s highly recommended that payroll tax software is used in order to:

- Ensure accuracy of the amount of tax calculated

- Ensure compliance with government requirements and regulations

- Reduce the risk of fines and other penalties as the result of inaccuracies

What do I need to do to use a payroll system?

In order to use a payroll system, you need to understand your business needs and weigh the benefits of the different systems.

You also need to understand the different types of payroll system options you have.

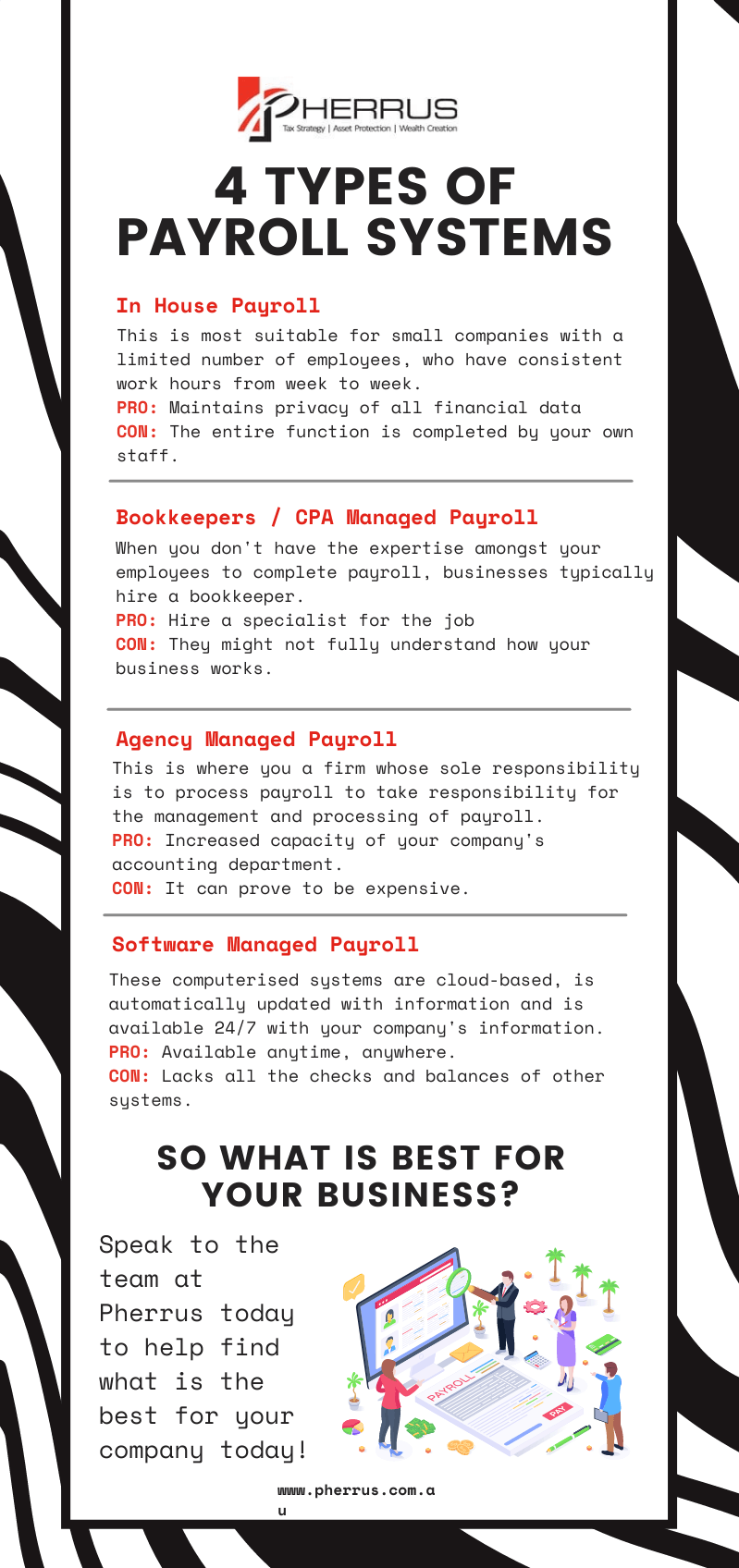

4 types of payroll systems (+ pros & cons)

In the next few paragraphs, you’ll learn about the four types of payroll systems and their advantages and disadvantages.

This will help you decide which system would be best for your company.

1. In-House Payroll

In-House payroll is most suitable for small companies with a limited number of employees, who have consistent work hours from week to week.

There are several features of an in-house payroll system, such as:

- Completed by an in-house employee

- Uses stand alone payroll software or integrated payroll software to calculate payroll

- Processes payroll that has a limited amount of irregularities and complexities

Pros of in-house payroll

- In-house payroll maintains company privacy because all of the financial data remains with staff who work for the company.

- The entire function of the payroll process is completed by your staff, including making bank deposits.

Cons of in-house payroll

- In-house payroll requires that the company keeps its payroll employee apprised of any changes to payroll tax laws and labour laws.

- In-house payroll lacks the checks and balances of other systems and can be prone to errors that may take longer to be identified.

2. Bookkeepers/CPA managed payroll

When a company realises they don’t have the expertise amongst their employees to complete payroll or they have payroll needs that exceed the capacity of their staff, they typically hire a bookkeeper or a CPA to manage the payroll process.

There are several features of a bookkeeper/CPA managed payroll system, such as:

- Completed by an outside bookkeeper/CPA who is specialised in payroll

- Payroll is completed using a payroll software system that is automated and monitored by the bookkeeper/CPA

- Provides increased capacity and capability to the company’s staff

Pros of bookkeepers/CPA payroll

- One of the advantages of hiring an outside bookkeeper or CPA to complete payroll is that it increases the ability of the company’s accounting department because there are frequent changes to labour laws and payroll tax requirements.Having a staff member to focus on payroll ensures that the company is in compliance with the most current regulations.

- Another advantage of hiring an outside bookkeeper or CPA is that it brings in an increased level of expertise within the company that can decrease the possibility for errors in the processing of the payroll, taxes and deductions.

- By hiring an outside firm or bringing an independent bookkeeper or CPA into the company to complete payroll, the firm is creating a system of checks and balances in the payroll process.

Con of bookkeepers/CPA payroll

- One of the disadvantages of hiring an outside bookkeeper or CPA to complete payroll is that they may not be familiar with the workings of the company and can be prone to making mistakes that an in-house employee might not make.

- Another disadvantage of an outside bookkeeper or CPA firm is that they may not complete the entire payroll process, still requiring your employees to be involved in completing payroll.

3. Agency managed payroll

Agency managed payroll involves getting a firm whose sole responsibility is to process payroll to take responsibility for the management and processing of your company’s payroll.

There are several features of an agency managed payroll system, such as:

- Agency managed payroll will engage experts in payroll who bring a great level of expertise to your company.

- An agency will take over all of the functions of processing your payroll from administrative work to deductions and bank deposits.

Pros of agency managed payroll

- Increased capability and capacity of your company’s accounting department.

- Increase expertise in the area of payroll for your company.

- Assurance of the accuracy of the payroll process.

- Decrease in the risk of mistakes as the work is typically guaranteed by the company.

Cons of agency managed payroll

Agency managed payroll can incur a greater expense for you than the other options, but the assurance of accuracy and timeliness is worth it if your company can afford it.

4. Software managed payroll

An emerging option in the world of payroll management is to use a software managed solution.

When considering this option, you may think of a list of payroll systems like the Xero payroll software or MYOB payroll system or Quickbooks payroll software.

These computerised payroll systems are gaining popularity because it is cloud-based, is automatically updated with information and is available 24/7 with your company’s information.

There are several features of a software managed payroll system, such as:

- Cloud-based and available from any location, at any time.

- Automatically calculates payroll information based on the employee data that is input into the system from time records and other systems.

Pros of software managed payroll

- Available at any time, anywhere.

- Provides automatic calculations.

Cons of software managed payroll

While computerised payroll systems are beneficial, the weakness of this payroll system is:

- Requires in-house employees to engage with the system.

- Lacks the checks and balances of other systems that engage outside expertise.

So, which payroll system is best for your businesses?

While there is a range of options available to you in the world of payroll management, the option that best suits your company is one that:

- Reduces the possibility of errors.

- Has the highest level of expertise available to your company.

- Creates the greatest capacity and capability for your business.

While some options may suit a small or medium-sized business, it’s important that you identify payroll software for large companies and search for the best payroll software for large businesses in your quest to find the most suitable system for your company.

Having professionals on your team when it comes to payroll is priceless and will increase the chances of your employees – the most valuable asset of your business – being happy and continuing to provide great results for your company.

If you would like to learn more about the different payroll systems available and how Pherrus Financial Services can help, contact us today on 02 9099 9109.