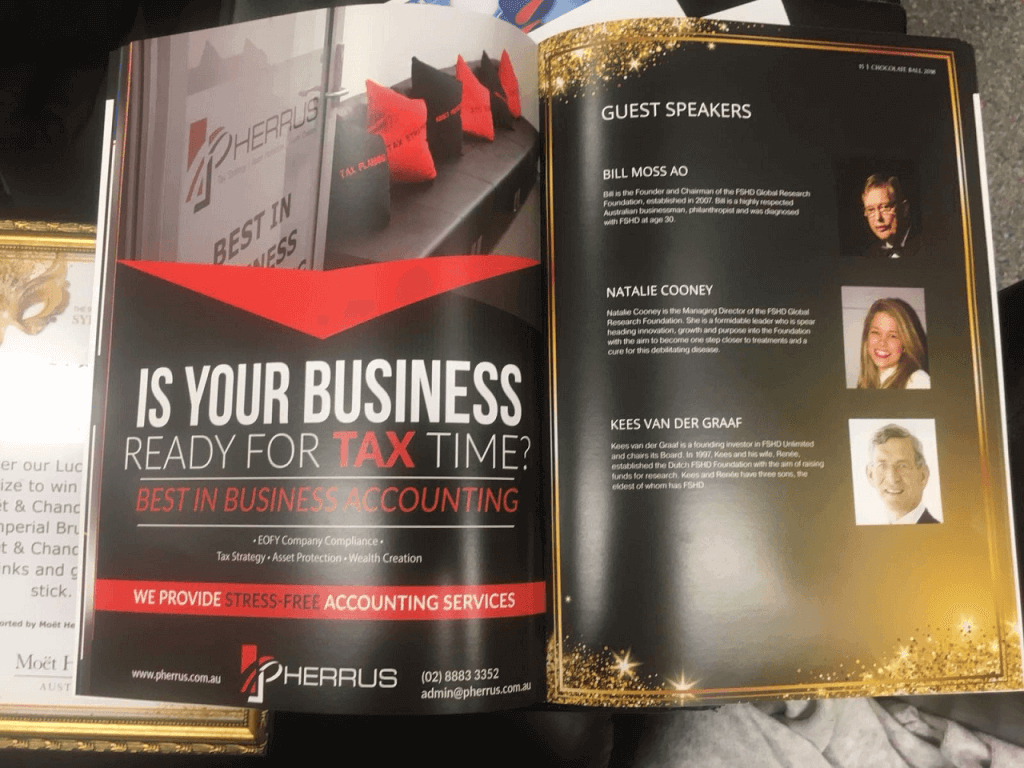

The Sydney Chocolate Ball is an annual event, celebrating its ninth incarnation this year. Here at Pherrus Financial, we are excited to announce that we attended this year’s event. We are proud to be giving back to our community in such a meaningful way. Here’s what you need to know about the Chocolate Ball.

The Event

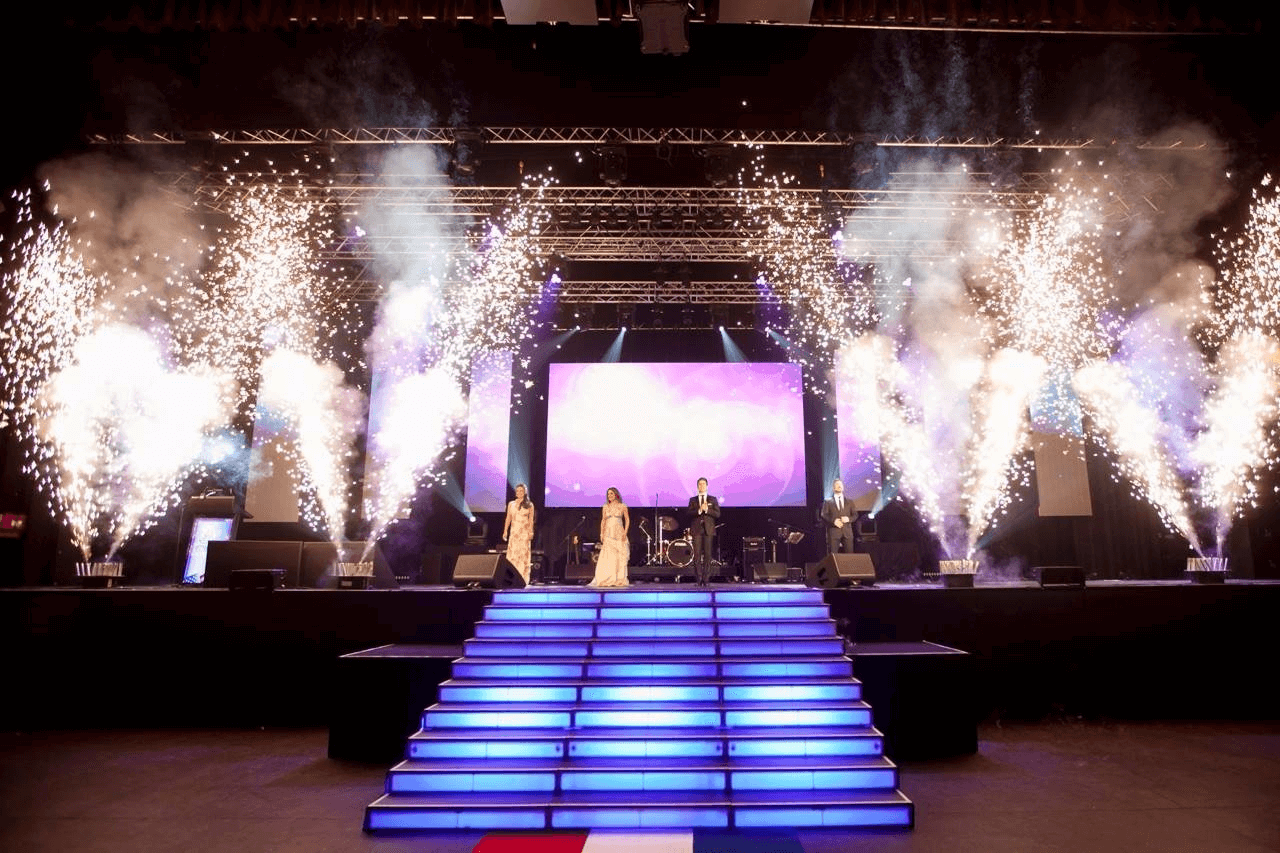

This year’s Chocolate Ball was held Saturday, 16 June at the Star Event Centre in Sydney. Starting at 6 p.m., the black-tie masquerade ball continued on into the wee hours. Champagne was flowing freely throughout the night and renowned chef Luke Mangan provided a delicious menu for guests. All of the dishes served was inspired by chocolate, of course, in keeping with the theme of the evening.

Wonderful food and beverages aside, the real reason everyone attended the Chocolate Ball was for the cause it supports. Proceeds from the event go to the FSHD Global Research Foundation. This organisation works tirelessly to find a cure for Facioscapulohumeral Dystrophy (FSHD). Over time, this incurable, irreversible disease causes the muscles to weaken and deteriorate, leaving the sufferer helpless against the effects.

Tickets to the event typically sell out well in advance, so we registered early to ensure the Pherrus Foundation was supporting the event.

Looking to the Future

Although there is no cure for FSHD as of yet, the hope is that continued support from the community will enable researchers to find a viable treatment for this aggressive disease. We are proud to be a part of this effort. As we work in wealth creation and management, it is only fitting that we use some of that wealth to help those who are less fortunate. It is not just about building goodwill in our community, but also ensuring that we and others can live the best lives possible.

Here at Pherrus Financial, we truly care about our clients and the ones they care about as well. In helping others to achieve the wealth of their dreams, we hope to inspire more people to follow a similar path and give back in their communities as well. One of the greatest things about having wealth is the ability to use that wealth to assist those in need. Helping others can provide far more fulfilment and happiness than any material purchase ever could.

If you are inspired to start building your own wealth so you can share it with your loved ones and those in need, the experts at Pherrus Financial will be more than happy to help. We’ll help you manage your investments and charitable donations to ensure you are complying with the latest tax regulations while also maximising your returns. Reach out to us today to learn more about our services and start building your fortune.