You’ve just finished your tax return at tax time. The hard part is done.

But then you look at the pile of receipts, invoices, and digital files you’ve gathered over the past year.

Now you’re wondering: Do I have to keep all of this?

It’s a common dilemma. Individuals, sole traders, and small business owners alike wonder how long to keep tax records in Australia.

On one hand, you don’t want to risk throwing out something the Australian Taxation Office might ask for later.

On the other hand, keeping every document “just in case” quickly turns into a filing nightmare.

Let’s find out how long you have to keep tax records in Australia to make tax record-keeping one less thing to stress about.

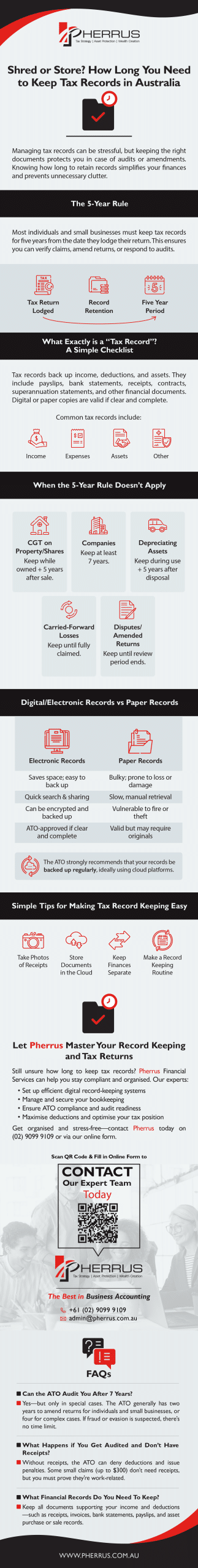

The 5-Year Rule

For most individuals and small businesses in Australia, the Australian Taxation Office requires you to keep tax records for five years.

Not five years from the end of the financial year, but five years from the date you lodge your tax return.

For example, if you lodge your 2025 tax return on October 20, 2025, you must keep those records until October 20, 2030.

If you lodge late, the five-year period still starts from the actual date you submitted the return, not from when it was due.

Keeping your records for this whole period is important in case the ATO asks you to verify your claims or if you need to amend your return later.

Throwing out records too early can leave you unprepared in the event of an audit or review.

What Exactly is a “Tax Record”? A Simple Checklist

A tax record is any document that backs up the information you’ve included in your tax return.

If you claim a deduction, report income, or declare an asset, you need something to prove it.

Tax records can be physical or digital. The ATO accepts both, as long as they’re clear, complete, and easy to access if requested.

Common tax records include

- Income Records: Payslips, PAYG payment summaries (now called Income Statements in myGov), bank statements showing interest, dividend statements, rental property income statements from agents, and business income records.

- Expense and Deduction Records: Business receipts and invoices for work-related expenses, credit card and bank statements, car/travel logbooks, and donation receipts.

- Asset Records (for CGT): Purchase and sale contracts for property or shares, records of all associated costs (stamp duty, legal fees, brokerage fees), and financial records of property improvement costs.

- Other Key Records: Private health insurance statements, superannuation contribution records, and financial records of any government payments or offsets received during the year.

When the 5-Year Rule Doesn’t Apply

While the general rule is to keep tax records for five years, several situations require records to be kept for longer.

Capital Gains Tax (CGT) on Property and Shares

If you own assets that could trigger Capital Gains Tax (CGT), such as an investment property, shares, or cryptocurrency, you must keep complete records for the entire time you own the asset.

Keep records of

- Purchase price and contracts

- Stamp duty and settlement fees

- Legal, agent, and brokerage fees

- Improvement or renovation costs

- Interest, insurance, land tax, and repairs

- Valuations or market assessments

- Sale contracts and settlements

Once you’ve sold the asset and declared the CGT event in your tax return, you need to hold onto those records for an additional five years after you sell, or otherwise dispose of, the asset.

For example, if you buy an investment property in 2025 and sell it in 2045, you need to keep all records related to the asset for 25 years!

Companies

If you’re a sole trader, the standard five-year rule applies to most of your tax records.

However, if you operate through a company, different rules apply.

Under the Corporations Act 2001, all Australian companies must keep financial records for at least seven years after the transactions they relate to are completed.

This legal requirement overrides the ATO’s five-year rule when it comes to company documents.

So even if the ATO only requires five years for tax purposes, you still need to meet the seven-year minimum for corporate compliance.

Depreciating Assets

There are special rules for depreciating assets.

If your business claims depreciation on items such as vehicles, tools, or office equipment, you must maintain records for the duration of ownership and for five years after the asset is no longer in use or sold.

Carried-Forward Losses

The same principle applies to carried-forward tax losses.

If your business makes a tax loss in a given year, typically from running expenses exceeding income, you may be able to carry that loss forward and apply it to reduce taxable income in future years.

In this case, you must keep all records relating to that loss until it’s fully claimed and the period of review for the final return it’s applied to has passed.

Depending on how long it takes to use up the loss, this may mean holding onto records well beyond the standard five-year window.

Disputes or Amended Assessments

If your tax return is amended or there’s a dispute, for example, if the ATO adjusts your assessment after data‑matching or you request an amendment, you’ll need to keep related records for five years from lodgement or until the ATO’s review period ends-whichever is later.

A review period is the timeframe in which assessments can be changed by you or by the ATO.

This period is generally two years for individuals and small businesses (24/23 and earlier years – 2years from 25/24 onwards 4 years), and four years for other taxpayers.

Each amendment restarts this review period, so hold onto records until the latest review period has expired.

Digital/Electronic Records vs Paper Records

The ATO accepts both original paper records and electronic or digital copies as valid tax records, provided they meet strict standards.

If you scan, photograph, or otherwise digitise a receipt or invoice, it must be a true, clear, and complete copy of the original and meet ATO requirements for format, readability, and authenticity.

Once you have saved a digital version that faithfully replicates the original, you don’t have to store the paper copy, unless other laws require keeping the original (certain property or legal contracts).

Just be sure the digital version is fully legible and stored in a way where the ATO could easily inspect it if requested.

Going digital comes with advantages. You can

- Free up physical space

- Organise your records more efficiently

- Search through documents quickly using keywords

- Better protect your records against damage or loss caused by fire, flood, or theft

The ATO strongly recommends that your records be backed up regularly, ideally using cloud platforms like Google Drive, OneDrive, Dropbox, or compatible accounting software.

You should also be able to export or download records in case you change providers or offline access becomes necessary.

Simple Tips for Making Tax Record Keeping Easy

- Take Photos of Receipts: Use your phone to snap photos of receipts as soon as you get them. Make sure the image is clear and complete. Apps like ATO myDeductions or even your phone’s Notes app can help you store and label them easily.

- Store Documents in the Cloud: Accounting software platforms like Xero and MYOB let you attach receipts and invoices directly to transactions, keeping everything organised in one place.

- Separate Business and Personal Expenses: Sole traders and investors should use a dedicated bank account or credit card for all business or investment transactions. This makes tracking simpler and more accurate.

- Schedule Regular Record-Keeping Time: Set aside 15–30 minutes each week or month to upload tax receipts, label documents, and check your records. You’ll be saved from a big end-of-year backlog.

Let Pherrus Master Your Record Keeping and Tax Returns

Still unsure how long to keep tax records in Australia?

Pherrus Financial Services is here to help. We’re tax and accounting experts. We can

- Advise you on setting up efficient digital record-keeping systems.

- Provide comprehensive bookkeeping services to manage your records, ensuring everything is captured and secure.

- Offer peace of mind that your financial records are always ATO-compliant and audit-ready.

- Use your records to make sure you claim every legitimate deduction at tax time.

- Implement smart tax strategies to maximise your tax position and support long-term financial growth.

You don’t need to drown in paperwork and tax receipts any longer! Contact us today to get organised for good.

Fill out our online form or call (02) 9099 9109.

FAQ

Can the ATO Audit You After 7 Years?

Yes, the ATO can audit you after seven years, but only in specific circumstances.

The ATO’s standard review periods (also known as “statutes of limitations”) allow them to amend assessments within two years for most individuals and small businesses, or four years for more complex tax affairs.

However, if the ATO suspects tax evasion or fraud, there is no time limit for audits.

What Happens if You Get Audited and Don’t Have Receipts?

If you’re audited and don’t have receipts, the ATO may deny your deductions and apply penalties.

You can make some low-value claims (like up to $300 for work expenses) without receipts, but you must still show how the expenses relate to your income.

What Financial Records Do You Need To Keep?

You need to keep records that support the income, deductions, and claims on your tax return.

Such records include receipts, invoices, bank statements, payslips, contracts, and records of asset purchases and sales.