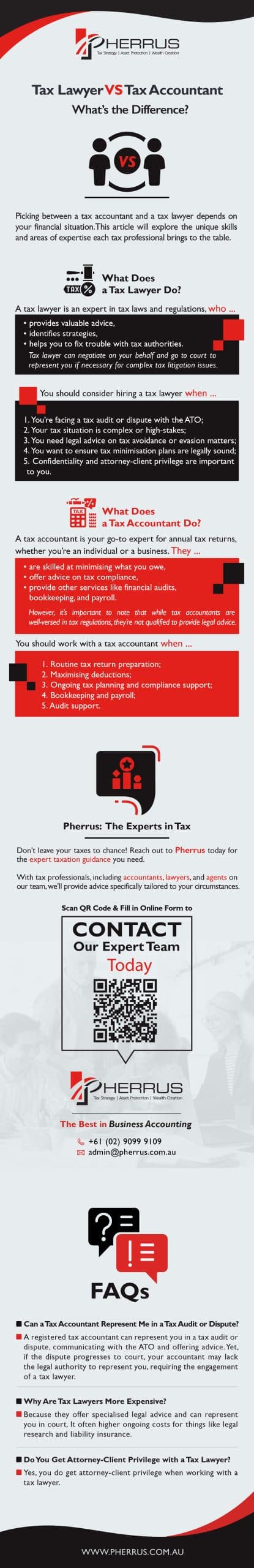

Just like choosing between a GP and a specialist depends on your ailment, picking between a Ma href=”https://www.pherrus.com.au/tax-agent-services-guide/”>tax accountant and a tax lawyer depends on your financial situation.

Are you dealing with straightforward income and deductions, or are you wrestling with complex tax-related legal issues?

This article will explore the unique skills and areas of expertise each tax professional brings to the table. Keep reading to find out which is right for your financial healthcare.

Key Takeaway BoxA tax accountant focuses on preparing your tax returns and offering general tax planning advice. They cannot represent you in legal disputes. In contrast, a tax lawyer specialises in legal aspects of taxation, providing advice on complex tax issues and representing you in court if necessary. |

What Does a Tax Lawyer Do?

A tax lawyer is an expert in tax laws and regulations, providing valuable advice to help you understand your legal obligations and rights.

They can identify strategies within the bounds of the law to save you money on taxes.

If you run into trouble with tax authorities, such as during audits or disputes, you’ll want a tax lawyer on your side.

They can negotiate on your behalf and go to court to represent you if necessary for complex tax litigation issues.

If you owe back taxes, a tax lawyer can negotiate settlements and payment plans with tax agencies, making the burden easier to manage.

For those with international dealings, a tax lawyer advises on tax planning and compliance across borders.

When Should You Work with a Tax Lawyer?

You should consider hiring a tax lawyer when

- You’re facing a tax audit or dispute with the ATO due to possible discrepancies in filed tax returns, undeclared income, or suspicious deductions.

- Your tax situation is complex or high-stakes, such as owning multiple businesses or having significant investment income.

- You need legal advice on tax avoidance or evasion matters like offshore accounts or accusations of tax fraud.

- You want to ensure tax minimisation plans are legally sound so you don’t face penalties later.

- Confidentiality and attorney-client privilege are important to you.

What Does a Tax Accountant Do?

A tax accountant is your go-to expert for annual tax returns, whether you’re an individual or a business.

They’ll make sure you file accurately and on time.

And they’re skilled at minimising what you owe by identifying deductions, credits, and other tax liability-reducing opportunities at tax time and all year round.

Beyond just filing, a tax accountant can offer advice on tax compliance, helping you understand what you need to do to stay within the law.

While their main focus is taxes, these accountants can provide other accounting services to help you better manage your finances, like financial audits (checking your business’s compliance with accounting regulations), bookkeeping, and payroll.

However, it’s important to note that while tax accountants are well-versed in tax regulations, they’re not qualified to provide legal advice.

When Should You Work with a Tax Accountant?

You should work with a tax accountant in the following scenarios:

- Routine tax return preparation. If your tax situation is straightforward without the need for legal advice, routine tax return preparation by a tax accountant will save you time and avoid costly errors.

- Maximising deductions. A tax accountant can identify credits and deductions to reduce your taxable income.

- Ongoing tax planning and compliance support. Consistent advice will help you stay on track throughout the year, not just at tax time.

- Bookkeeping and payroll. Consolidating these financial tasks under one professional will streamline your operations so you can focus on other aspects of your business or personal life.

- Audit support. Even though they cannot legally represent you, a tax accountant can prepare the necessary documents and offer advice on interacting with tax authorities.

FAQs about Tax Lawyers vs. Tax Accountants

Can a Tax Accountant Represent Me in a Tax Audit or Dispute?

A registered tax accountant can represent you in a tax audit or dispute.

They are authorised to act on your behalf, communicate with the ATO, and provide advice and assistance during the audit or dispute process.

However, in the unlikely event that the dispute escalates to the point where it goes to court, your tax accountant may not have the legal authority to represent you in a court of law.

In such cases, you would likely need to engage a tax lawyer.

Why Are Tax Lawyers More Expensive?

Tax lawyers are generally more expensive because they offer specialised legal advice and can represent you in court.

Court representation often involves higher ongoing costs for things like legal research and liability insurance.

A tax lawyer’s expertise comes from additional years of education learning to navigate complex legal issues, which also justifies their higher fees.

Do You Get Attorney-Client Privilege with a Tax Lawyer?

Yes, you do get attorney-client privilege when working with a tax lawyer.

Your conversations and information are confidential and protected by law, offering a secure environment for discussing sensitive tax issues.

Pherrus: The Experts in Tax

The choice between tax lawyers vs. tax accountants depends on your unique financial situation.

Each has their set of skills, whether tax planning and preparing annual tax returns or offering legal advice on taxation matters.

Don’t leave your taxes to chance! Reach out to Pherrus today for the expert taxation guidance you need.

With tax professionals, including accountants, lawyers, and agents on our team, we’ll provide advice specifically tailored to your circumstances.

Fill in our online form today or call +61 (02) 9099 9109 to book an appointment at our Bella Vista office in Sydney, NSW.