Pherrus Financial Attended the Sydney Chocolate Ball

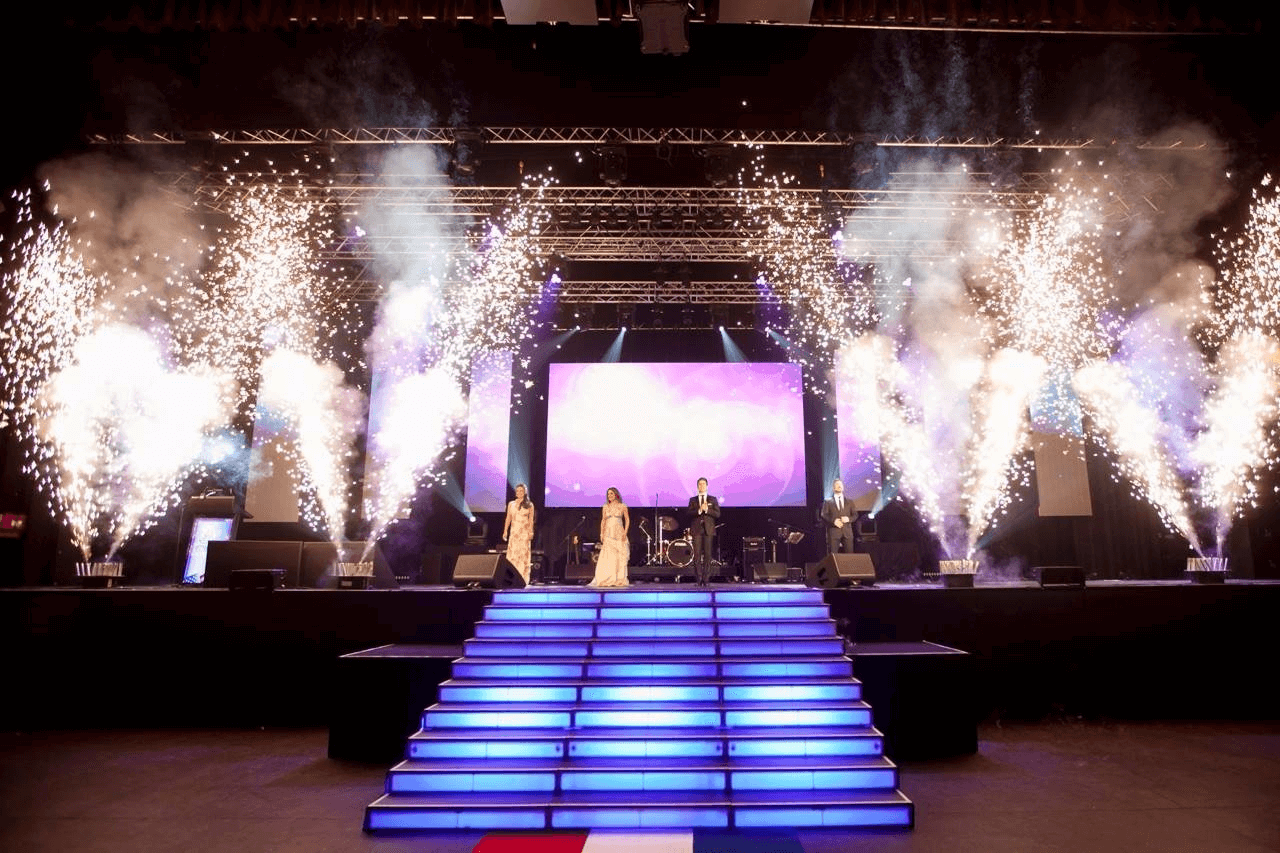

The Sydney Chocolate Ball is an annual event, celebrating its ninth incarnation this year. Here at Pherrus Financial, we are excited to announce that we attended this year’s event. We are proud to be giving back to our community in such a meaningful way. Here’s what you need to know about the Chocolate Ball. The…